(Finance) – Piazza Affari closes in negativebeing the worst among the European stock exchanges, in one day with few ideas given the long weekend of the Immaculate Conception. On the macroeconomic front, in Germany in October industrial production surprised on the downside, with a change of -0.4% m/m compared to +0.2% expected and -1.3% previously, recording the fifth consecutive monthly decline. However, the most important macro data will arrive tomorrow: US non-agricultural payrolls will impact investor expectations regarding possible interest rate cuts by the Federal Reserve next year.

L’Euro / US Dollar continues trading with a fractional gain of 0.24%. L’Gold maintains the position essentially stable at 2,027.2 dollars an ounce. Slight increase in petrolium (Light Sweet Crude Oil) which rises to 69.6 dollars per barrel.

On the levels of the day before spreadwhich remains at +174 basis points, with the yield of the ten-year BTP which stands at 3.94%.

Among the Euroland indices without momentum Frankfurtwhich trades with -0.16%, London is stable, reporting a moderate -0.02%, and a cautious trend for Pariswhich shows a performance of -0.1%.

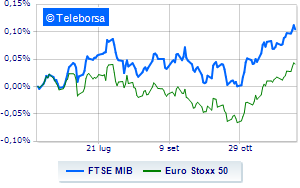

Caution prevails in closing a Business Squarewith the FTSE MIB which closed the session with a drop of 0.67%; along the same lines, sells the FTSE Italia All-Share, which closes at 32,091 points. On the levels of the day before the FTSE Italia Mid Cap (-0.08%); on the same trend, it consolidates the levels of the day before FTSE Italia Star (-0.1%).

From the closing data of Milan, the exchange value in the session of 7/12/2023 it was equal to 2.41 billion euros, down (-8.94%) compared to the previous 2.65 billion; while the volumes traded went from 0.62 billion shares in the previous session to 0.62 billion.

Among the best Blue Chips of Piazza Affari, Fineco advances by 1.55%. Substantially toned Moncler, which records a capital gain of 0.85%. Moderate earnings for Mediobanca, which advances by 0.78%. Small steps forward for Ternawhich marks a marginal increase of 0.77%.

The worst performances, however, were recorded on Saipem, which closed at -4.14%. Sales galore BPM desk, which suffers a decrease of 3.94%. It slides BPER, with a clear disadvantage of 2.73%. In red MPS Bankwhich highlights a sharp decline of 2.65%.

At the top of the mid-cap stocks ranking from Milan, Acea (+1.93%), Saras (+1.64%), Pharmanutra (+1.62%) e Brunello Cucinelli (+1.58%).

The steepest declines, however, occurred on SOL, which closed the session at -3.76%. The negative performance of Eurogroup Laminationswhich fell by 3.74%. Ariston Holding drops by 3.66%. Decline decided for Digital Valuewhich marks -2.88%.