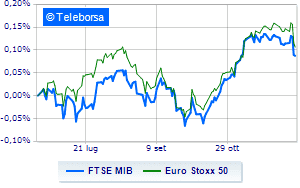

(Tiper Stock Exchange) – Negative balance for the main European stock exchanges. The US market was also negative. What is frightening the global stock markets is above all the intention of the global central banks to continue with the interest rate hikes to curb high inflation. The Milan Stock Exchange manages to dodge the sales and close the session just below the parity line in day of the “four witches” where index futures, stock futures, index options and stock options expire at the same time.

On the currency market, theEuro / US Dollar, which continues the session on the previous day’s levels and stops at 1.063. Seat up slightly for thegold, advancing to $1,789.1 an ounce. Oil (Light Sweet Crude Oil) dropped by 2.38%, falling to 74.3 dollars per barrel.

Slightly up spreadswhich stands at +211 basis points, with a timid increase of 4 basis points, with the yield of the 10-year BTP equal to 4,

Among the European lists slow day for Frankfurtwhich marks a decline of 0.67%, sales up Londonwhich recorded a drop of 1.25%, and a negative session for Paris, which shows a loss of 1.08%. Closing on parity for the Milan Stock Exchange, with the FTSEMIB which stands at 23,688 points, while, on the contrary, sales on the FTSE Italia All-Sharewhich closed the day at 25,757 points, down sharply by 3.32%.

The exchange value in today’s session in Piazza Affari it was equal to 2.61 billion euros, with an increase of no less than 1,125.9 million euros, equal to 75.94%, compared to the previous 1.48 billion; while the volumes traded went from 0.42 billion shares in the previous session to today’s 0.71 billion.

At the top of the ranking of the most important titles of Milan, we find Azimuth (+6.03%), Intesa Sanpaolo (+3.19%), Phinecus (+2.47%) and Unicredit (+1.77%).

The strongest sales, however, fell on DiaSorinwhich finished trading at -3.68%.

Under pressure Inwitwhich shows a drop of 2.55%.

Slide Herawith a clear disadvantage of 2.34%.

In red A2Awhich shows a marked decrease of 2.16%.

At the top among Italian stocks a mid-cap, Intercos (+7.55%), doValue (+4.48%), SOL (+3.79%) and Saras (+3.14%).

The strongest sales, however, fell on Replywhich finished trading at -6.86%.

Bad sitting for Caltagirone SpAwhich drops by 6.53%.

The negative performance of CIRwhich drops by 3.65%.

Sesa drops by 3.37%.

Among the data relevant macroeconomics:

Friday 12/16/2022

01:30 Japan: Manufacturing PMI (exp. 49 points; previous 49 points)

08:00 United Kingdom: Retail sales, annual (exp. -5.6%; previous -5.9%)

08:00 United Kingdom: Retail Sales, Monthly (exp. 0.3%; prev. 0.9%)

10am European Union: Manufacturing PMI (exp. 47.1 points; previous 47.1 points)

10am European Union: Composite PMI (expected 48 points; previous 47.8 points).