(Tiper Stock Exchange) – The values for Piazza Affari are weak, while the other European markets are moving in sharp decline, discounting some profit taking and the possibility of new restrictive moves by central banks (Fed and ECB). The disappointing data on retail sales in the Eurozone also weighed in, while the indie Sentix did better than expected on the sentiment of stock traders.

L’Euro / US Dollar it is substantially stable and stops at 1.078. Seat up slightly for thegold, advancing to $1,873.8 an ounce. Light Sweet Crude Oil continued trading, up 0.84% to $74.01 per barrel.

Advance a little spreadswhich reaches +176 basis points, showing an increase of 3 basis points, with the yield on the 10-year BTP equal to 4.01%.

Among the European lists in red Frankfurtwhich shows a marked fall of 0.88%, the negative performance of Londonwhich fell by 0.72%, and Paris drops by 1.32%.

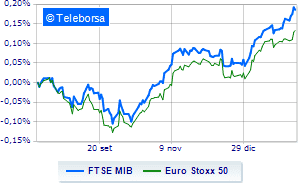

The Milanese price list continues the session just below parity, with the FTSEMIB which cuts 0.55%; on the same line, it ranks below parity the FTSE Italia All-Sharewhich recedes to 29,044 points.

Negative changes for the FTSE Italia Mid Cap (-0.83%); along the same lines, down the FTSE Italy Star (-0.71%).

Among the best Blue Chips of Piazza Affari, toned Intesa Sanpaolo which highlights a nice advantage of 2.60%.

In light Telecom Italywith a large progress of 1.83%.

Positive balance for amplifierwhich boasts an increase of 1.36%.

Basically tonic BPM deskwhich recorded a capital gain of 1.17%.

The strongest declines, however, occur on Monclerwhich continues the session with -3.61%.

Decided decline for Phinecuswhich marks a -3.42%.

Under pressure STMicroelectronicswith a sharp drop of 2.93%.

He suffers Interpumpwhich shows a loss of 2.69%.

Between best stocks in the FTSE MidCap, Alerion Clean Power (+2.68%), Italmobiliare (+1.26%), Pharmanutra (+1.18%) and El.En (+1.10%).

The strongest declines, however, occur on MPS Bankwhich continues the session with -4.40%.

Prey of sellers Soul Holdingwith a decrease of 3.66%.

They focus their sales on Mfe Bwhich suffers a drop of 3.50%.

Sales on Carel Industrieswhich records a drop of 2.87%.