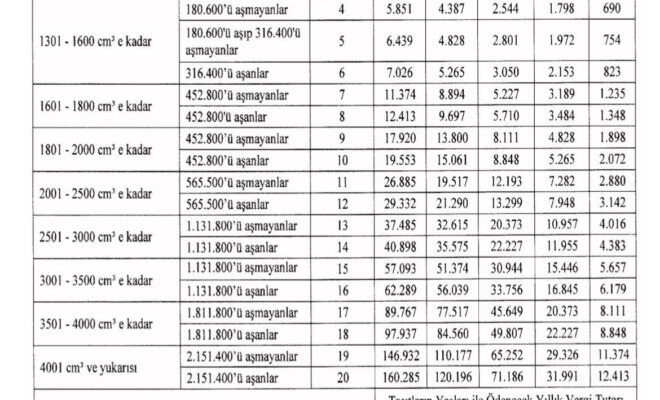

It will be paid in 2024 Motor Vehicle Tax (MTV) The amounts became clear. An official table has arrived on this subject.

On this subject, journalist Emre Özpeynirci said: “Motor Vehicle Tax (MTV) was also increased at a revaluation rate of 58.46% in the new year. Here are the new MTV amounts we will pay in 2024 He said and read the table below where you can see the amount you will pay. shared:

Motor Vehicle Tax (MTV) was also increased by a revaluation rate of 58.46% in the new year.

Here are the new MTV amounts we will pay in 2024 👇 pic.twitter.com/3KzHdxcpkT

— Emre Özpeynirci (@eozpeynirci) December 30, 2023

Of course, there will be increases in other items in 2024. For example in someday According to the news, the fees charged from valuable papers as of 2024 have been determined. The costs of valuable papers such as notary paper, declaration, passport, ID and driver’s licenses were increased in proportion to the revaluation rate (Approximately 58 percent). According to the general notification of the General Directorate of Accounting published in today’s issue of the Official Gazette Fees to be collected from valuable papers; for notary paper and declaration From 55 TL to 87 TL, in protest and ex officio acts From 110 TL to 174 TLin passports From 501 TL to 790 TLon ID cards From 83 TL to 130 TL, driver’s licenses from 624 TL to 990 TLfor each sheet of bank checks. It was increased from 33 TL to 55 TL. The decision will be valid as of January 1, 2024.

YOU MAY BE INTERESTED IN

Unfortunately, there will be other increases in 2024. For example, in order for smartphones brought from abroad to be used in Turkey without any problems, there is a fee that must be paid. IMEI registration fee, After the last decision came into force, 20 thousand TL had risen to the level. While the increase from 6 thousand TL to 20 thousand TL at that time still seems incredible, the registration fee is full with the Revaluation Rate (RRA) to be updated to 58.46 percent in the new year. 31.692 TL will rise to the level.

Ozan Bingöl explains exactly the following on this subject: had conveyed: “The Revaluation Rate for 2023 was 58.46%. So next year; “The fee for mobile phones brought from abroad for personal use will increase from 20,000 lira to 31,692 lira, the vehicle inspection fee for a car will increase from 1,149.60 lira to 1,821.66 lira, and the lowest radar fine will increase from 951 lira to 1,506.95 lira.” So, how much has the IMEI registration fee changed over the years? The surprising current answer is exactly as follows:

-2015: 131.50₺

-2018: 500₺

-2019: 1.500₺

-2020: 1.838,70₺

-2021: 2.006,20₺

-2022: 2.732,40₺

-2023 July 7: 6.091,30₺

-2023 July 8 and After: 20,000₺

-2024: 31.692₺

So what is this Revaluation Rate? In this regard, Bingöl made the following statement: doing: “During periods of high inflation, the Revaluation Rate gains a quality that directly and significantly affects every segment of society. Especially in recent years, many people have had to become more familiar with the concept of revaluation rate. Because, the revaluation rate is taken as basis in annual increases in fixed amounts related to taxes, penalties, fees, tariffs and similar items.

According to Article 298 bis of the Tax Procedure Law; The revaluation rate is the average price increase rate in the General Index of Domestic Producer Prices (D-PPI) in October of the year to be revalued compared to the same period of the previous year. The revaluation rate is a derivative rate produced from D-PPI data. For example, while the revaluation rate for 2022 is 122.93%, the annual PPI rate as of October 2022 is 157.69%.”