(Finance) – Overbearing rise for Morgan Stanleywhich shows a searing climb of 4.35% on previous values.

The best quarterly forecast by analysts announced by the American investment bank before the start of the market contributes to assisting the shares. “We recorded solid results in the fourth quarter in a difficult market environment – commented CEO James Gorman – Overall, 2022 was a good year for the company as our clear strategy and balanced business model allowed us to achieve a ROTCE of 16% despite the complex macro environment”.

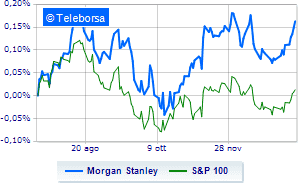

Comparatively on a weekly basis, the trend of Morgan Stanley shows a more marked trend than the trendline of theS&P 100. This demonstrates the greater propensity of investors to buy towards Morgan Stanley compared to the index.

The trend of short of Morgan Stanley is strengthening with resistance area seen at USD 96.07, while the most immediate support is seen at 95.12. Expect continuation of uptrend towards 97.02.