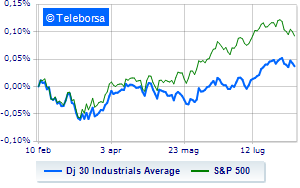

(Tiper Stock Exchange) – Weak session for the US price listtrading down 0.41% on Dow Jones; along the same lines, theS&P-500 it has a depressed trend and trades below the previous levels at 4,476 points. Negative the NASDAQ 100 (-0.87%); as well as, negative changes to theS&P 100 (-0.76%).

In light of the North American S&P 500 the compartment power. In the price list, the sectors informatics (-1.18%), secondary consumer goods (-0.96%) and telecommunications (-0.87%) are among the best sellers.

Operators wait for i tomorrow’s inflation data, which are expected to show CPI rising to 3.3% year-on-year in July, marking the first acceleration since June 2022, while the core CPI (which excludes volatile food and energy prices) is expected to decline slightly to 4.7%. Also, await the quarterly’s Walt Disneywhich will release the data after the market closes.

On the macroeconomic frontit emerged that mortgage interest rates jumped across the board last week, hitting the mortgage application, with total application volume down 3.1% last week compared to the previous week, according to the Mortgage Bankers Association report. Weekly oil inventories were up 5.9 million barrels.

As for the progress of the monetary policy, Patrick Harker (Philadelphia Fed) suggested that in the absence of “alarming” surprises from forthcoming data, the hike cycle could be over, adding however that rates will then have to remain unchanged for some time for monetary policy to “do its Work”. Thomas Barkin (Richmond Fed), on the other hand, did not give any indications on its expectations for the September meeting, but stressed that inflation is still too high.

At the top of the rankings American giants components of the Dow Jones, Dow (+0.72%) and Caterpillar (+0.63%).

The worst performances, however, are recorded on Salesforce, which gets -2.57%. Undertone intel showing a filing of 1.41%. Disappointing JP Morgan, which lies just below the levels of the eve. Slack Goldman Sachswhich shows a small decrease of 1.36%.

To the top between Wall Street tech giantsthey position themselves Fortinet (+1.92%), Enphase Energy (+1.73%), Modern (+1.40%) and Regeneron Pharmaceuticals (+1.37%).

The strongest sales, on the other hand, show up Nvidia, which continues trading at -3.97%. Sensitive losses for Tradedesk, down 3.86%. Sales on Datadog, which records a drop of 3.68%. Bad sitting for polishwhich shows a loss of 3.62%.