(Finance) – The second half of Wall Street begins the same way the first one did: with the red sign to distinguish the performance of the majority of companies. The number one concern always remains that aggressive decisions by central banks to bring runaway inflation under control will end up causing a recession.

Investors find themselves valuing several macroeconomic data: the Purchasing Managers Index (PMI) manufacturing in June decreased due to moderation in demand, theISM manufacturing in the same month it fell due to supply chain constraints and investments used to finance new residential construction projects (private and public) fell in May.

On the corporate announcement front, Kohl’s (US department store chain) announced the failure of exclusive negotiations with Franchise Group to be acquired by the latter, Micron Technology (American semiconductor multinational) has released disappointing guidance on the cooling the chip marketwhile NIO, Xpeng And Auto them (Chinese electric vehicle manufacturers) reported increasing sales in June.

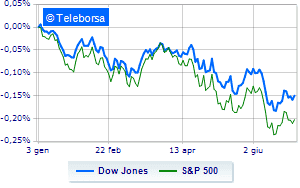

Wall Street moves fractionally downwith the Dow Jones which is leaving 0.35% on the parterre; on the same line, with a slight decrease inS & P-500, which continues the day below par at 3,770 points. In red the Nasdaq 100 (-0.81%); on the same trend, in fractional decline theS&P 100 (-0.46%).

The sector stands out in the S&P 500 basket utilities. In the list, the worst performances are those of sectors informatics (-1.18%), telecommunications (-0.92%) e materials (-0.51%).

At the top of the ranking of American giants components of the Dow Jones, McDonald’s (+ 1.46%), Coke (+ 0.82%), Home Depot (+ 0.57%) e Verizon Communication (+ 0.52%).

The strongest falls, on the other hand, occur on Intelwhich continues the session with -3.56%.

Under pressure Nikewith a sharp decline of 1.91%.

Suffers Cisco Systemswhich shows a loss of 1.78%.

Prey of the sellers 3Mwith a decrease of 1.41%.

To the top between tech giants of Wall Streetthey position themselves Docusign (+ 4.78%), Atlassian (+ 4.08%), Modern (+ 4.01%) e Okta (+ 3.98%).

The worst performances, on the other hand, are recorded on KLA-Tencorwhich gets -7.85%.

Bad performance for Lam Researchwhich recorded a decline of 7.68%.

Black session for Applied Materialswhich leaves a loss of 6.83% on the table.

At a loss Asml Holding Nv Eur0.09 Ny Registrywhich falls by 6.63%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Friday 01/07/2022

15:45 USA: Manufacturing PMI (preceding 57 points)

4:00 pm USA: ISM manufacturing (expected 54.9 points; previous 56.1 points)

Tuesday 05/07/2022

4:00 pm USA: Industry orders, monthly (expected 0.5%; previous 0.3%)

Wednesday 06/07/2022

15:45 USA: Composite PMI (preceding 53.6 points)

15:45 USA: PMI services (preceding 53.4 points).