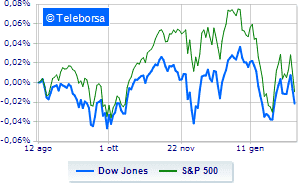

(Finance) – After a start on the edge of parity, Wall Street turned downwith the Dow Jones which is leaving 0.23% on the parterre; along the same lines, sells theS & P-500, which falls back to 4,478 points. Downhill the Nasdaq 100 (-1.25%); on the same trend, just below parity theS&P 100 (-0.67%). Sectors stand out in the S&P 500 basket power (+ 1.79%) e utilities (+ 0.66%). In the list, the sectors Informatics (-1.17%), secondary consumer goods (-1.17%) e telecommunications (-0.89%) are among the best sellers.

On the macroeconomic front, the University of Michigan survey showed that the consumer sentiment US fell to their lowest levels of more than a decade in early February. The returns of the Treasury they remain above 2% as traders weigh the prospect of a tighter timing for a rate hike by the Federal Reserve. “We won’t really know what the Fed will do until it happens – said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder – There is a lot of data between now and the next Fed meeting to consider. “” There is little chance that the FED will not act, but I still believe we will see signs of restraint. inflation between now and the Fed meeting and a 25 basis point hike is the most likely move, ”Ghriskey added.

Between protagonists of the Dow Jones, Chevron (+ 1.39%), Walgreens Boots Alliance (+ 1.06%), Merck (+ 0.91%) e DOW (+ 0.89%).

The strongest falls, on the other hand, occur on Salesforce.Comwhich continues the session with -2.98%.

Decline for Nikewhich marks a -2%.

Under pressure Honeywell Internationalwith a sharp decline of 1.11%.

Modest descent for Microsoftwhich yields a small -0.9%.

On the podium of the Nasdaq titles, Regeneron Pharmaceuticals (+ 3.52%), Modern (+ 2.93%), Micron Technology (+ 2.21%) e Bed Bath & Beyond (+ 1.93%).

The strongest falls, on the other hand, occur on Xilinxwhich continues the session with -6.80%.

Flat Garminwhich holds equality.

Sensitive losses for Illuminatedown 5.30%.

Breathless Nvidiawhich falls by 4.19%.

Between macroeconomic variables most important in the North American markets:

Friday 11/02/2022

4:00 pm USE: University of Michigan Consumer Confidence (expected 67.5 points; preceded 67.2 points)

Tuesday 15/02/2022

14:30 USE: Empire State Index (expected 10 points; previous -0.7 points)

14:30 USE: Production prices, monthly (expected 9.6%; previous 0.2%)

14:30 USE: Production prices, annual (expected 9.2%; previous 9.7%)

Wednesday 16/02/2022

14:30 USE: Export prices, monthly (expected 0.9%; previous -1.8%).