(Finance) – Wall Street moves fractionally down, after the publication of the inflation data showing a slowdown below market expectations.

“The Fed is counting on inflation in the US to return to normal levels, otherwise it risks having to raise interest rates in restrictive territory, potentially destroying demand and collapsing the economy “- he comments Nick Chatters, investment manager of Aegon Asset Management -. Today’s inflation figure of 8.3% will certainly not put the Fed to sleep tonight: the consensus was for a decline to 8.1%, after the high of 8.5% recorded in March. Not just oil: core inflation also surprised on the upside and airfares increased by 18% on a monthly basis. So – concludes Chatters – at least for now, the thesis of a longer and higher than expected price pressure remains intact “.

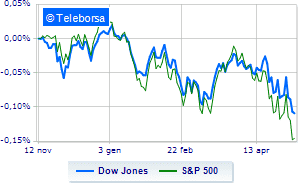

Among the US indices, the Dow Jones it is leaving 0.28% on the parterre; on the same line, with a slight decrease inS & P-500, which continues the day below par at 3,975 points. Depressed the Nasdaq 100 (-1.76%); as well as, negative changes for theS&P 100 (-0.96%).

In the S&P 500, the sub-funds performed well power (+ 2.32%), utilities (+ 1.63%) e materials (+ 0.52%). In the list, the worst performances are those of the sectors secondary consumer goods (-2.40%), informatics (-1.84%) e telecommunications (-0.81%).

Between protagonists of the Dow Jones, Chevron (+ 2.22%), DOW (+ 2.03%), Visa (+ 2.02%) e Merck (+ 1.96%).

The worst performances, on the other hand, are recorded on Applewhich gets -3.53%.

Goes down Home Depotwith a decrease of 2.17%.

Collapses Microsoftwith a decrease of 2.13%.

The negative performance of Salesforcewhich falls by 1.96%.

Between best performers of the Nasdaq 100, Electronic Arts (+ 10.40%), Booking Holdings (+ 2.88%), Exelon (+ 2.40%) e Fortinet (+ 2.16%).

The strongest sales, on the other hand, show up on Lucidwhich continues trading at -10.24%.

Sales hands on Mercadolibrewhich suffers a decrease of 8.20%.

Bad performance for Zscalerwhich recorded a drop of 6.09%.

Black session for Crowdstrike Holdingswhich leaves a loss of 5.83% on the table.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Wednesday 11/05/2022

14:30 USA: Consumption prices, yearly (8.1% expected; previous 8.5%)

14:30 USA: Consumption prices, monthly (expected 0.2%; previous 1.2%)

16:30 USA: Oil stocks, weekly (expected -457K barrels; previous 1.3 million barrels)

Thursday 12/05/2022

14:30 USA: Production prices, monthly (expected 0.5%; previous 1.4%)

14:30 USA: Production prices, annual (expected 10.7%; previous 11.2%).