(Tiper Stock Exchange) – Wall Street is moving positively after that one A key measure of US inflation fell slightly more than expected last month, suggesting that the Federal Reserve may be nearing the end of its intense interest rate hike. Within the communication on US incomes and consumption in February, it emerged that the core PCE price index rose by 0.3% in the second month of the year, just below analysts’ expectations for a +0 .4%.

The measure was also eagerly awaited because in the Eurozone, inflation seems to be stickier than expected: Core consumer prices rose 1.2% last month, offsetting the reversal of peak energy prices. However, headline inflation fell to 6.9% from 8.5%.

On the political front, Donald Trump is about to become the first former US president to face criminal chargesafter a grand jury voted to indict him over payments he made to a former porn star during his 2016 campaign. It’s not yet clear what charges Trump will face when he is arraigned (which is expected on Tuesday).

Among the most observed data in recent weeks are those concerning the liquidity required by US lenders from the central bank. Yesterday, i Fed’s weekly balance sheet data they showed a stabilization of pressures associated with the turbulence in the banking system, with a marginal decline in emergency lending. Utilization of the discount window fell to $88 billion from $110 billion the previous week, while loans originated under the Bank Term Funding Program established in mid-March increased to $64 billion from $54 billion and loans disbursed through the “other extensions of credit” are almost stable at 180 billion.

The Secretary of the Treasury Janet Yellen yesterday he claimed that there is work still to be done to complete the reforms started after 2008 to protect financial stability and indicated that the deregulation of recent years needs to be reassessed in the light of recent events. From the Fed, Susan Collins (Boston Fed) said she expects “a little more restriction”.

Among most significant corporate announcements, Virgin Orbit it announced a workforce reduction of approximately 675 employees, who make up approximately 85% of the total workforce, in order to reduce expenses in light of “the company’s inability to obtain significant financing.” BlackBerry reported a quarterly loss of $495 million, while Kraft Heinz will sell the baby food business in Russia to a local producer.

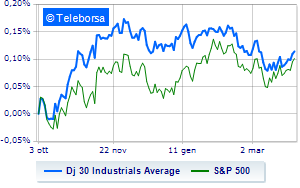

Slight increase for the Wall Street Stock Exchangewith the Dow Jones which rises by 0.53% to 33,032 points, consolidating the series of three consecutive increases, which began last Wednesday; along the same lines, slight increase forS&P-500, which rises to 4,070 points. Slightly positive the NASDAQ 100 (+0.41%); with analogous direction, in fractional progress theS&P 100 (+0.41%).