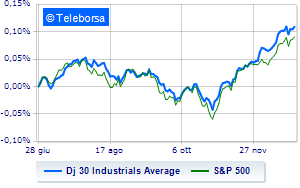

(Finance) – Slight increase for the Wall Street stock market, with the Dow Jones which rises by 0.34% to 37,674 points, while, on the contrary, theS&P-500 (New York), which is positioned at 4,783 points, close to previous levels. On the levels of the day before the Nasdaq 100 (+0.19%); along the same lines, consolidates the levels of the day beforeS&P 100 (+0.2%).

Optimism reigns in the markets driven by expectations that the Federal Reserve could start cutting rates as early as March.

The sector is in good evidence in the S&P 500 secondary consumer goods.

To the top between giants of Wall Street, Caterpillar (+0.91%), Goldman Sachs (+0.69%), Amgen (+0.68%) e Honeywell International (+0.63%).

The steepest declines, however, occur at Walt Disneywhich continues the session with -0.74%.

Disappointing Nikewhich lies just below the levels of the day before.

Between protagonists of the Nasdaq 100, Tesla Motors (+2.20%), Modern (+2.12%), Dollar Tree (+1.21%) e MercadoLibre (+1.10%).

The strongest sales, however, occur at AirBnbwhich continues trading at -1.63%.

Lame Palo Alto Networkswhich shows a small decrease of 1.48%.

Modest descent for Alphabetwhich drops a small -1.09%.

Thoughtful Alphabetwith a fractional decline of 1.02%.

Between macroeconomic variables of greatest importance in North American markets:

Thursday 12/28/2023

2.30pm USA: Wholesale inventories, monthly (expected -0.2%; previously -0.4%)

2.30pm USA: Unemployment Claims, weekly (expected 210K units; previously 205K units)

4:00 pm USA: Home sales in progress, monthly (expected 0.9%; previously -1.5%)

5pm USA: Oil inventories, weekly (previously 2.91 million barrels)

Friday 12/29/2023

3.45pm USA: Chicago PMI (expected 51 points; previously 55.8 points).