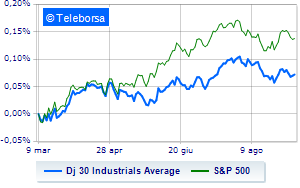

(Finance) – Wall Street continues trading fractionally higher, reducing part of the losses suffered in recent days, even if it is about to end the week with a minus sign. The index Dow Jones at the moment it rises by 0.21% to 34,574 points, while theS&P-500 at 4,459 points. Fractional earnings for the Nasdaq 100 (+0.29%); on the same trend, with a moderate increase inS&P 100 (+0.28%).

A series of factors penalized the US markets data better than expectationswhich raise fears for further ones restrictive moves by the Fed or a prolongation of the period of high rates.

Positive result in the S&P 500 basket for sectors power (+1.30%), utilities (+0.60%) e informatics (+0.51%). The sector industrial goodswith its -0.43%, is the worst of the market.

To the top between giants of Wall Street, Amgen (+2.23%), Microsoft (+1.64%), Salesforce (+1.31%) e Apple (+1.24%).

The strongest sales, however, occur at Boeingwhich continues trading at -1.89%.

Disappointing Verizon Communicationwhich lies just below the levels of the day before.

Slack Intelwhich shows a small decrease of 0.71%.

Modest descent for Procter & Gamblewhich drops a small -0.63%.

Between protagonists of the Nasdaq 100, Warner Bros Discovery (+3.08%), Gilead Sciences (+2.75%), Marriott International (+2.75%) e Paccar (+2.60%).

The strongest sales, however, occur at Polishedwhich continues trading at -3.08%.

It slides Align Technologywith a clear disadvantage of 2.30%.

In red Zoom Video Communicationswhich highlights a sharp decline of 2.12%.

The negative performance of IDEXX Laboratorieswhich drops by 2.00%.