(Finance) – The Wall Street Stock Exchange is moving upwards. If on the one hand investors are galvanized by the boom in Netflix subscribers, on the other hand they are worried about Google’s announcement that it has decided to cut 12,000 employees. Cuts that also come a few days after the announcement to this effect by other big companies such as Microsoft, Amazon, Meta Platforms and Salesforce.

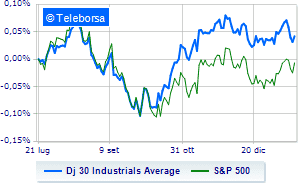

Among US indices, the Dow Jones rises by 0.27% to 33,134 points; along the same lines, theS&P-500 the day continues with an increase of 0.86%. Rev up the NASDAQ 100 (+1.59%); on the same line, salt theS&P 100 (+0.92%).

At the top of the rankings American giants components of the Dow Jones, Microsoft (+2.91%), Walt Disney (+2.73%), American Express (+2.73%) and Salesforce, (+2.64%).

The strongest declines, however, occur on Goldman Sachswhich continues the session with -2.54%.

Basically weak Johnson & Johnsonwhich recorded a decrease of 1.03%.

It moves below parity Merckshowing a decrease of 0.90%.

Moderate contraction for Verizon Communicationwhich suffers a drop of 0.74%.

Between best performers of the Nasdaq 100, Netflix (+6.52%), match groups, (+5.60%), Baidu (+5.33%) and Atlassian (+4.67%).

The strongest sales, on the other hand, show up Astrazenecawhich continues trading at -2.26%.

Bad sitting for Kraft Heinzwhich shows a loss of 1.69%.

Undertone Gilead Sciences, showing a filing of 1.13%.

Disappointing NetEasewhich lies just below the levels of the eve.

Between macroeconomic quantities most important of the US markets:

Friday 01/20/2023

4:00 pm USA: Sale of existing houses (expected 3.96 million units; previous 4.08 million units)

4:00 pm USA: Existing home sales, monthly (exp. -5.4%; previous -7.9%)

Monday 01/23/2023

4:00 pm USA: Leading indicator, monthly (previously -1%)

Tuesday 24/01/2023

3.45pm USA: Composite PMI (previously 44.6 points)

3.45pm USA: Manufacturing PMI (previously 46.2 points).