According to the regulation published in the Official Gazette this morning, mobile phone SCT base values were reduced.

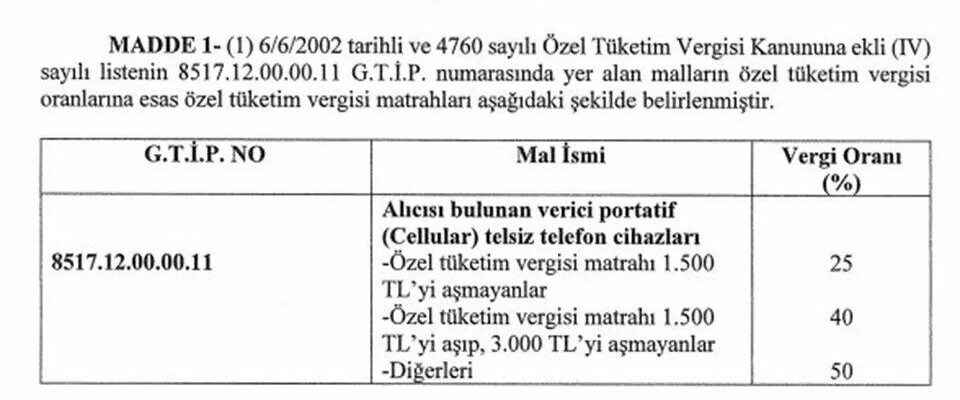

A new regulation was made in the mobile phone excise tax base. According to the statement published in the Official Gazette this morning, the tax rate is 25 percent for mobile phones with a special consumption tax base not exceeding 1,500 TL, 40 percent for phones between 1,500 and 3 thousand TL, and 50 percent for phones that cost more than 3 thousand TL. determined.

New regulation on mobile phone ÖTV base

The previously mentioned 25 percent tax bracket included phones not exceeding 1,200 TL, and the 40 percent bracket included phones worth between 1,200 and 2,400 TL. With the new regulation, some discounts will come to cheap mobile phones.

Due to the change in the SCT tax brackets, a discount of approximately 300 TL is expected for phones with a value of 3 thousand TL, and a discount of about 500 TL for phones with a price range of 5 thousand to 6 thousand TL.