(Finance) – The indices of Piazza Affari and of the other main European lists are all negative. Investors are grappling with the decisions of the European Central Bank (ECB)which, after a further surge in inflation, is determined to end purchases of quantitative easing government bonds and to proceed with a rate hike.

L’Euro / US dollar the session continued at the levels of the day before, reporting a variation of + 0.07%. Sitting in fractional reduction for thegold, which for now leaves 0.26% on the parterre. The oil market was essentially stable, continuing the session at the levels of the day before with oil (Light Sweet Crude Oil) trading at $ 122.1 per barrel.

On parity it spreadwhich remains at +200 basis points, with the yield on the ten-year BTP standing at 3.34%.

Among the main European stock exchanges hesitates Frankfurtwhich yields 0.48%, substantially weak Londonwhich recorded a decline of 0.46%, and little moved Pariswhich shows a -0.12%.

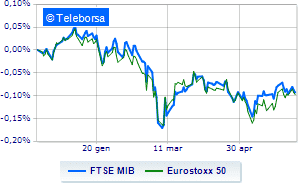

The Milanese list continues the session just below par, with the FTSE MIB which files 0.48%: the main index of the Milan Stock Exchange thus continues a negative series, which began last Tuesday, of three consecutive declines; on the same line, the FTSE Italia All-Sharewhich falls back to 26,371 points.

Below parity the FTSE Italia Mid Cap, which shows a decrease of 0.50%; as well, the slightly negative FTSE Italia Star (-0.49%).

Between best Italian stocks large cap, in evidence BPERwhich shows a strong increase of 2.97% on the eve of the presentation of the industrial plan 2022-2025which CEO Montani will unveil tomorrow morning in Milan.

It stands out Unicredit which marks an important progress of 2.11%.

Good performance for Pirelliwhich grew by 1.44%.

Sustained Banco BPMwith a decent gain of 1.27%.

The strongest sales, on the other hand, show up on Tenariswhich continues trading at -3.04%.

Breathless Iveco Groupwhich falls by 3.02%.

Thud of Saipemwhich shows a fall of 2.29%.

Letter on Italgaswhich records a significant decline of 2.26%.

Among the protagonists of the FTSE MidCap, Wiit (+ 1.61%), Intercos (+ 1.53%), Technogym (+ 1.45%) e Italmobiliare (+ 1.08%).

The worst performances, on the other hand, are recorded on SOLwhich gets -2.77%.

Goes down Replywith a decrease of 2.74%.

Collapses Ariston Holdingwith a decrease of 2.25%.

Sales hands on Sesawhich suffers a decrease of 2.11%.

Between the data relevant macroeconomics:

Thursday 09/06/2022

07:30 France: Employment, quarterly (previous 0.6%)

14:30 USA: Unemployment Claims, Weekly (Expected 210K Units; Previously 200K Units)

Friday 10/06/2022

01:50 Japan: Production prices, monthly (expected 0.5%; previous 1.2%)

03:30 China: Consumption prices, annual (expected 1.8%; previous 2.1%)

03:30 China: Production prices, annual (7,7% expected; previous 8%).