(Finance) – The indices of Piazza Affari and of the other main European lists are all negative, with sentiment remaining negative on concerns about a worsening of the energy crisis and Eurozone growth prospects. One of the highlight of the week will be the release of the report onUS inflation (scheduled for tomorrow afternoon). Still on the macroeconomic front, it collapsed the German ZEW index in July 2022, signaling a significant deterioration in economic sentiment in the coming months, with the climate remaining negative.

BlackRockthe largest wealth manager in the world, said he is now “Underweight” on US, European equities and the United Kingdom due to the worsening economic outlook, while maintaining a neutral position on the Japanese, Chinese and emerging market equity markets. “The Great Moderation, a period of stable growth and inflation, is over“BlackRock Vice President Philipp Hildebrand and his team said in their mid-year outlook.

Under the lens of investors, today, there are also the speech of Villeroy of the ECB and that of Barkin of the FED. On the US front, according to Raphael Bostic, president of the Federal Reserve in Atlanta, the recession in the US is avoidable even with other interest rate hikes.

Caution prevails onEuro / US dollar, which continues the session with a slight decrease of 0.29%. L’euro continues to weaken against the dollar and trade at the lows of the last 20 years against the greenback. L’Gold it is essentially stable at $ 1,735.7 per ounce. The Petroleum (Light Sweet Crude Oil) collapsed 2.32%, falling as low as $ 101.7 per barrel.

On the levels of the eve it spreadwhich remained at +202 basis points, with the yield of Ten-year BTP which is positioned at 3.10%.

In the European stock market scenario small loss for Frankfurtwhich trades at -0.65%, remains close to par London (-0.14%), and hesitates Pariswhich yields 0.33%.

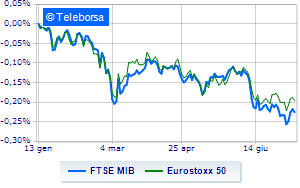

In Milan, it moves under parity on FTSE MIB, which drops to 21,430 points, with a percentage difference of 0.64%; on the same line, depressed the FTSE Italia All-Sharewhich trades below the levels of the eve at 23,469 points.

Negative on FTSE Italia Mid Cap (-0.87%); on the same trend, negative changes for the FTSE Italia Star (-1.47%).

Between best performers of Milan, in evidence Leonardo (+ 2.60%), Tenaris (+ 1.41%), STMicroelectronics (+ 1.17%) e Inwit (+ 0.98%).

The strongest sales, on the other hand, show up on Saipemwhich continues trading at -33.76%.

Sales hands on BPERwhich suffers a decrease of 4.72%.

Bad performance for Banco BPMwhich recorded a decline of 4.04%.

Sales on Unicreditwhich recorded a decline of 3.48%.

Between best stocks in the FTSE MidCap, doValue (+ 2.14%), Brunello Cucinelli (+ 1.89%), ENAV (+ 0.90%) e ERG (+ 0.84%).

The worst performances, on the other hand, are recorded on Sesawhich gets -5.24%.

Black session for Juventuswhich leaves a loss of 4.45% on the table.

At a loss Tinextawhich falls by 3.15%.

Heavy Mfe Bwhich marks a drop of -3.14 percentage points.

Among macroeconomic appointments which will have the greatest influence on market trends:

Tuesday 12/07/2022

01:50 Japan: Production prices, monthly (expected 0.5%; previous 0%)

11:00 am Germany: ZEW index (expected -38.3 points; preceding -28 points)

Wednesday 13/07/2022

08:00 Germany: Consumption prices, annual (7.6% expected; previously 7.9%)

08:00 Germany: Consumption prices, monthly (expected 0.1%; previous 0.9%)

08:00 United Kingdom: Industrial production, annual (expected -0.5%; previous 0.7%).