(Tiper Stock Exchange) – Seat not for the Milan Stock Exchange, which does much worse than the other European markets due to the weight of the banks, on a day characterized by a generally negative climate. Investors find themselves evaluating the attempted mutiny by Wagner group mercenaries over the weekend in Russia and the possible implications for the war in Ukraine.

Furthermore, S&P Global has cut its 2023 growth estimates for China due to the uneven nature of the post-Covid recovery which requires further stimuli; the rating agency assumes a GDP of +5.2%, down from the previous +5.5%, due to weak consumption and a struggling real estate market.

On the macroeconomic front, the German business morale deteriorated for the second consecutive month in June, according to a survey by the IFO Institute.

Caution prevails overEuro / US Dollar, which continues the session with a slight drop of 0.41%. L’Gold trading continues with a fractional gain of 0.58%. Slight drop in petrolium (Light Sweet Crude Oil), which drops to 69.01 dollars per barrel.

On equality it spreadswhich remains at +154 basis points, with the yield of the 10-year BTP which stands at 3.84%.

Among the markets of the Old Continent moderate contraction for Frankfurtwhich suffered a drop of 0.67%, negative session for Londonshowing a loss of 0.80%, and under pressure Pariswhich shows a drop of 0.75%.

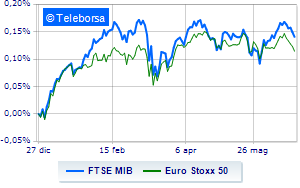

“No” day for the Italian stock exchangedown by 1.17% on FTSEMIB, continuing the bearish trail of three consecutive declines, which started last Thursday; along the same lines, bad day for the FTSE Italia All-Sharewhich continues the session at 28,940 points, down 1.14%.

Down the FTSE Italia Mid Cap (-0.72%); with similar direction, negative the FTSE Italy Star (-1.09%).

They go down or lose ground all the Blue Chips in Milan.

The worst performances are recorded on Leonardo, which gets -5.39% (in line with the European fund after the weekend news in Russia). Hands-on sales BPER, which suffers a decrease of 4.25%. Slide MPS Bank, with a clear disadvantage of 3.01%. In red BPM deskwhich shows a marked decrease of 2.89%.

At the top of the mid-cap rankings from Milan, Maire Tecnimont (+5.51%, after petrochemical contracts for 2 billion dollars in Saudi Arabia), De’Longhi (+2.06%), Caltagirone SpA (+1.76%) and Pharmanutra (+1.00%).

The strongest declines, however, occur on Juventus, which continues the session with -2.90%. The negative performance of Banca Popolare di Sondriowhich drops by 2.32%. Danieli drops by 2.03%. Decided decline for Webuildwhich marks a -1.85%.