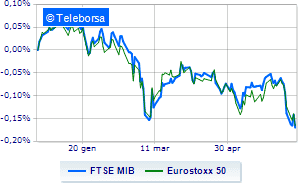

(Finance) – Sitting in a rally in Piazza Affari, which is in line with the positive day of the European stock exchanges. However, today’s day will not allow you to avoid recording heavy weekly losseswith interest rate hikes by central banks on both sides of the ocean adding to fears of an economic slowdown.

“The combination of higher rates, slowing growth and persistent inflation concerns represent for the moment strong headwinds for risk assets – said Mark Dowding, CIO of BlueBay – We believe that, for markets to stabilize, confidence in central banks will be a primary condition, but the incoming data will also need to clearly demonstrate that inflation concerns have been taken into account. consideration “.

On the macroeconomic front, Istat announced that the energy deficit Italian in April, while Eurostat confirmed that in May inflation of the Eurozone recorded + 8.1% on a trend basis.

They fly Rehabilitationwhich has signed the urban planning agreement with the Municipality of Milan for the variation to the project of Milan Santa GiuliaAnd Fincantieriwhich he will build for the American Navy the third Constellation-class missile frigate. In decline ERGwhich last night announced an agreement last night between the Garrone family holding company and IFM Investors, which will acquire an indirect share in the Italian energy company.

L’Euro / US dollar the session continued just below par, with a drop of 0.43%. Caution prevails ongold, which continues the session with a slight decrease of 0.56%. Light Sweet Crude Oil rose slightly, rising to 117.3 dollars per barrel.

Excellent level of spreadwhich falls up to +192 basis points, with a decrease of 12 basis points, with the yield of the 10-year BTP reaching 3.57%.

In the European stock market scenario sustained Frankfurtwith a decent gain of 1.39%, good insights on Londonwhich shows a large lead of 1.13%, and well set Pariswhich shows an increase of 1.30%.

A rain of purchases on the Milanese price list, which shows a gain of 2.19% on the FTSE MIB; on the same line, leap of FTSE Italia All-Sharewhich continues the day at 24,261 points.

Excellent performance of the FTSE Italia Mid Cap (+ 2.45%); on the same trend, the FTSE Italia Star (+ 2.28%).

Between best performers of Milan, in evidence Banco BPM (+ 7.45%), Campari (+ 5.21%), Pirelli (+ 5.14%) e Intesa Sanpaolo (+ 4.74%).

Between best stocks in the FTSE MidCap, Fincantieri (+ 7.01%), De ‘Longhi (+ 6.08%), Intercos (+ 5.33%) e Webuild (+ 4.79%).

The strongest falls, on the other hand, occur on ERGwhich continues the session with -2.24%.

Under pressure Antares Visionwhich shows a decrease of 1.16%.

It slips OVSwith a distinct disadvantage of 1.03%.

Between macroeconomic variables heavier:

Friday 17/06/2022

11:00 am European Union: Consumption prices, yearly (8.1% expected; 7.4% before)

11:00 am European Union: Consumption prices, monthly (expected 0.8%; previous 0.6%)

15:15 USA: Industrial production, monthly (expected 0.4%; previous 1.1%)

15:15 USA: Industrial production, annual (previous 6.4%)

4:00 pm USA: Leading indicator, monthly (expected -0.4%; previously -0.3%).