(Finance) – Sitting in a rally in Piazza Affari, which is in line with the positive day of the European stock exchanges. Today’s upward session comes at the end of another week marked by volatility and where investors continued to assess persistent surges in inflation, the prospect of aggressive monetary tightening and its impact on global economic growth. On the macroeconomic frontApril inflation data from France and Spain remained at high levels, while euro zone industrial production fell less than expected in March.

At Piazza Affari, eyes focused on insurance sectorwith Unipol And Unipolsai which this morning unveiled the strategic plan to 2024, which however did not warm the market. In addition to dividend estimates below expectations for UnipolSai, according to the president Carlo Cimbri “the investor who has more of a short-term and speculative matrix” may have wanted to “speculate on the so-called shortening of the chain of control”, a scenario that the Bolognese group is not taking into consideration.

No significant change for theEuro / US dollar, which trades on the eve of 1.039. Weak session forgold, which trades with a drop of 0.27%. Crude Oil (Light Sweet Crude Oil) continued the session higher and advanced at $ 107.8 per barrel.

Back to climb it spreadsettling at +192 basis points, with an increase of 7 basis points, with the yield of the ten-year BTP equal to 2.82%.

Among the Euroland indices money on Frankfurtwhich registers an increase of 1.37%, is flying Londonwith a marked rise of 1.59%, and it shines Pariswith a strong increase (+ 1.52%).

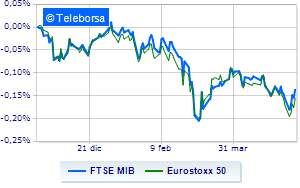

Plus sign for the Italian price list, with the FTSE MIB up by 1.18%; on the same line, the FTSE Italia All-Sharewhich increases compared to the day before reaching 26,020 points.

Effervescent the FTSE Italia Mid Cap (+ 1.68%); with similar direction, excellent performance of the FTSE Italia Star (+ 1.97%).

Among the best Blue Chips of Piazza Affari, excellent performance for DiaSorinwhich records a progress of 5.05%.

Exploit of Amplifonwhich shows an increase of 4.76%.

High STMicroelectronics (+ 4.52%).

Shopping hands-on Saipemwhich boasts an increase of 4.03%.

The strongest sales, on the other hand, show up on Unipolwhich continues trading at -9.23%.

Black session for Prysmianwhich leaves a loss of 2.08% on the table.

Negative sitting for Inwitwhich shows a loss of 1.70%.

It moves below par A2Ashowing a decrease of 0.89%.

Between best stocks in the FTSE MidCap, GVS (+ 12.91%), Carel Industries (+ 11.95%), Antares Vision (+ 10.67%) e Biesse (+ 9.64%).

The strongest sales, on the other hand, show up on UnipolSaiwhich continues trading at -6.34%.

At a loss Intercoswhich falls by 4.00%.

Heavy Secowhich marks a drop of -3.28 percentage points.

Under pressure Banca Ifiswhich shows a decline of 3.16%.

Between the data relevant macroeconomics:

Friday 13/05/2022

08:45 France: Consumption prices, annual (expected 4.8%; previous 4.5%)

08:45 France: Consumption prices, monthly (expected 0.4%; previous 1.4%)

9:00 am Spain: Consumption prices, monthly (expected -0.1%; previous 3%)

9:00 am Spain: Consumption prices, yearly (8.4% expected; previous 9.8%)

11:00 am European Union: Industrial production, monthly (expected -2%; previous 0.5%).