(Finance) – The main markets of Euroland and Piazza Affari are moving in positive territorywho are still pondering the Fed’s next non-obvious moves. A quiet market, typically Ferragostano, where the most striking news is the “move” of Exor in Amsterdam.

Caution prevails onEuro / US dollar, which continues the session with a slight decrease of 0.28%. L’Gold the session continues at the levels of the day before, reporting a variation equal to -0.04%. Oil (Light Sweet Crude Oil) continues trading, with an increase of 0.35%, to 94.67 dollars per barrel.

On parity it spreadwhich remains at +206 basis points, with the yield on the ten-year BTP standing at 3.07%.

In the European stock market scenario positive balance for Frankfurtwhich boasts a progress of 0.57%, substantially tonic Londonwhich records a capital gain of 0.48%, and moderate gain for Pariswhich is up by 0.47%.

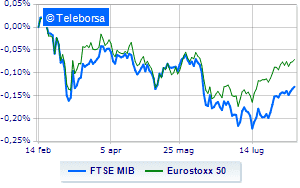

Piazza Affari continues the session with a fractional gain on FTSE MIB by 0.53%, consolidating the series of three consecutive increases, started last Wednesday; along the same lines, the FTSE Italia All-Share advances fractionally, reaching 25.145 points.

In fractional progress the FTSE Italia Mid Cap (+ 0.21%); just below parity the FTSE Italia Star (-0.33%).

Top of the ranking of the most important titles of Milan is there Nexi (+ 6.92%), which rips on the voices of interest of a private equity company.

They also run Banco BPM (+ 2.62%), Tenaris (+ 1.90%) e Unicredit (+ 1.33%).

Among the strongest falls it should be noted DiaSorinwhich continues the session with -1.25%.

Under pressure Prysmianwith a sharp fall of 1.02%.

Undertone Amplifon showing a 0.99% filing.

Disappointing STMicroelectronicswhich lies just below the levels of the eve.

Between best stocks in the FTSE MidCap, Banca Popolare di Sondrio (+ 2.75%), Anima Holding (+ 2.15%), doValue (+ 1.79%) e Juventus (+ 1.42%).

The strongest falls, on the other hand, occur on Replywhich continues the session with -1.66%.

Suffers Salcef Groupwhich shows a loss of 1.48%.

Lazy GVSwhich shows a small decrease of 0.82%.

Modest descent for Pharmanutrawhich yields a small -0.73%.