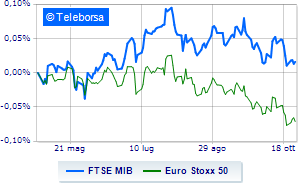

(Finance) – European stock markets remain in the red halfway through the session, while Piazza Affari shows greater resilience, together with the German square. The signs of strength coming from Wall Street could allow the markets to turn positive in the afternoon, but the caution prevails awaiting the agency’s judgement DBRS rating tonight and in view of the meeting of Fed next week.

L’Euro / US Dollar maintains the position substantially stable at 1.055. L’Gold it is essentially stable at 1,982.3 dollars an ounce. Rain of purchases on oil (Light Sweet Crude Oil), which shows a gain of 1.96%.

On equality, yes spreadwhich remains at +198 basis points, with the yield on the 10-year BTP standing at 4.82%.

Among the main European stock exchanges colorless Frankfurtwhich does not record significant changes compared to the previous session, without momentum Londonwhich is trading at -0.12%, is under pressure Pariswith a sharp decline of 0.99%.

Substantially stable Piazza Affari, which continues the session at the levels of the day before, with the FTSE MIB which stops at 27,458 points; on the same line, the FTSE Italia All-Share, with prices positioned at 29,196 points. Almost unchanged FTSE Italia Mid Cap (+0.2%); just below parity FTSE Italia Star (-0.48%).

At the top of the ranking of the most important titles of Milan, we find Saipem (+3.63%), Fineco (+2.34%), MPS Bank (+1.37%) e Unicredit (+1.25%).

The worst performances, however, are recorded on Monclerwhich marks -6.11% after the adjustments.

He suffers Amplifonwhich highlights a loss of 2.79%.

Prey for sellers Campariwith a decrease of 2.57%.

They focus on sales Nexiwhich suffers a decline of 2.54%.

At the top among Italian shares a mid-cap, De’ Longhi (+4.35%), Saras (+3.93%), Piaggio (+3.66%) e Saint Lawrence (+2.87%).

The steepest declines, however, occur at MFE Bwhich continues the session with -3.10%.

Sales up Buzzi Unicemwhich recorded a decline of 2.01%.

Negative session for Danieliwhich shows a loss of 1.79%.

Disappointing Brunello Cucinelliwhich lies just below the levels of the day before.