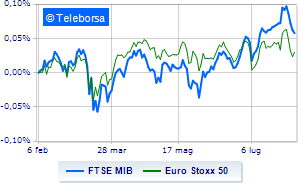

(Tiper Stock Exchange) – Piazza Affari closes fractionally lower, while Euroland grows moderately. The stars and stripes market was substantially tonic, with theS&P-500 posting a 0.55% capital gain after the labor market slowed pace in July.

Day of debuts in Milan, with three new freshmen on Euronext Growth Milan: Arras Group (technological real estate development company for second homes mainly in Sardinia), Execus (training and consultancy company specialized in the digital transformation of sales) and Porto Aviation Group ( aircraft design, development and manufacturing company).

On the currency market, plus sign for theEuro / US Dollar, which shows an increase of 0.85%. L’Gold trading continues with a fractional gain of 0.47%. Oil (Light Sweet Crude Oil) continues the session up and advances to 82.49 dollars per barrel.

Unchanged it spreadswhich stands at +167 basis points, with the yield on the ten-year BTP standing at 4.21%.

In the European stock market scenario positive balance for Frankfurtwhich boasts a progress of 0.37%, substantially tonic London, which recorded a capital gain of 0.47%; toned Paris which highlights a nice advantage of 0.75%. Weak session for the Milanese price list, which trades with a drop of 0.41% on FTSEMIB, continuing the series of four consecutive declines, which began last Tuesday; along the same lines, it yields to sales the FTSE Italia All-Sharewhich recedes to 30,607 points.

At the top of the ranking of the most important titles of Milan, we find Leonardo (+2.87%), MPS Bank (+2.80%), Tenaris (+2.22%) and Phinecus (+0.66%).

The worst performances, however, are recorded on Interpumpwhich gets -4.73%.

Under pressure DiaSorinwith a sharp drop of 2.66%.

He suffers STMicroelectronicswhich shows a loss of 2.49%.

Prey of sellers Registerwith a decrease of 2.40%.

Between best stocks in the FTSE MidCap, Banca Ifis (+4.55%), De Nora Industries (+4.45%), Saint Lawrence (+3.57%) and Saras (+2.57%).

The worst performances, however, are recorded on Intercoswhich gets -8.51%.

Black session for WIITwhich leaves a loss of 5.16% on the table.

They focus their sales on Ariston Holdingwhich suffers a drop of 3.03%.

Sales on Drywhich records a drop of 2.99%.