(Finance) – Brilliant business square, which is in line with the excellent performance of the main European stock exchanges. The American markets, meanwhile, are galloping andS & P-500 advances by 2.40%. The stock markets closed a week of strong tensions, worried by the trend of inflation and the war in Ukraine. Concerns remain high about possible more restrictive moves by the Federal Reserve. The news came from China, where Beijing aims to ease restrictions for Covid, assisted the rebound

On the currency market, theEuro / US dollar shows a timid gain, with an increase of 0.27%. Sitting in fractional reduction for thegold, which for now leaves 0.68% on the parterre. Heavy oil purchases (Light Sweet Crude Oil), showing a gain of 3.73%.

Jump up it spreadpositioning itself at +190 basis points, with an increase of 6 basis points, with the yield of the ten-year BTP equal to 2.85%.

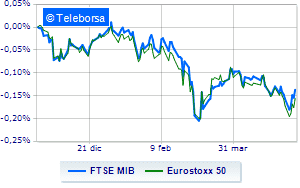

In the European stock market scenario flies Frankfurtwith a marked rise of 2.10%, it shines London, with a strong increase (+ 2.55%); excellent performance for Paris, which records a progress of 2.52%. Euphoric session for Piazza Affari, with the FTSE MIB which shows a jump of 2.05% in closing; along the same lines, the FTSE Italia All-Sharewhich with its + 2.09% ends at 26,245 points.

On the Milan Stock Exchange, the turnover in today’s session was equal to € 2.2 billion, down by € 323.9 million, compared to the € 2.52 billion of the previous day; volumes stood at 0.57 billion shares, compared to the previous 0.61 billion.

Out of 440 shares traded in Piazza Affari, 125 ended the session with a decline, while the increases were 308. The remaining 7 shares remained unchanged.

At the top of the ranking of the most important titles of Milan, we find Saipem (+ 9.29%), DiaSorin (+ 6.39%), STMicroelectronics (+ 6.03%) e Amplifon (+ 5.97%).

The worst performances, however, were recorded on Unipolwhich closed at -8.25%.

The negative performance of Inwitwhich falls by 1.27%.

Thoughtful Banco BPMwith a fractional decline of 0.78%.

He hesitates Nexiwith a modest fall of 0.73%.

Top of the ranking of mid-cap stocks from Milan, Carel Industries (+ 13.66%), Biesse (+ 11.57%), Antares Vision (+ 11.11%) e GVS (+ 10.56%).

The strongest declines, on the other hand, occurred on Intercoswhich closed the session at -5.92%.

Breathless Secowhich falls by 3.69%.

Thud of UnipolSaiwhich shows a 3.17% drop.

Banca Ifis drops by 2.65%.

Between the data relevant macroeconomics:

Friday 13/05/2022

08:45 France: Consumption prices, annual (expected 4.8%; previous 4.5%)

08:45 France: Consumption prices, monthly (expected 0.4%; previous 1.4%)

9:00 am Spain: Consumption prices, monthly (expected -0.1%; previous 3%)

9:00 am Spain: Consumption prices, yearly (8.4% expected; previous 9.8%)

11:00 am European Union: Industrial production, monthly (expected -2%; previous 0.5%).