(Finance) – Purchases widespread on European stock listswith the FTSE MIB which scores the same positive performance as the Old Continent. Today is anyway devoid of great ideas and consistent volumes, thanks to the closure of Wall Street for Juneteenth, a festival that commemorates the liberation of enslaved African people in the North American country. The trend of Piazza Affari also weighs many dividends of today.

The seat is also devoid of macroeconomic data significant, with the exception of producer prices in Germany, which remained at record levels on an annual basis, and the trend of the construction market in the Euro Zone in April 2022, which showed a decline on a monthly basis.

On the front of the new quotations, Energy (company active in the offer of integrated energy storage systems) has announced its intention to go public on Euronext Growth Milan (EGM), while De Nora Industries (multinational specialized in electrochemistry and active in the industrial production chain of green hydrogen) has identified an indicative valuation range of the shares, for a capitalization of up to 3.283 billion euros.

Slight increase forEuro / US dollar, which shows a rise of 0.31%. L’Gold the session continues at the levels of the day before, reporting a variation equal to -0.04%. Weak session for oil (Light Sweet Crude Oil), which is trading with a decline of 0.37%.

On parity it spreadwhich remains at +191 basis points, with the yield of the ten-year BTP which is positioned at 3.56%.

In the European stock market scenario small steps forward for Frankfurtwhich marks a marginal increase of 0.50%, well bought Londonwhich marks a strong rise of 1.11%, and a moderately positive day for Pariswhich rises by a fractional + 0.26%.

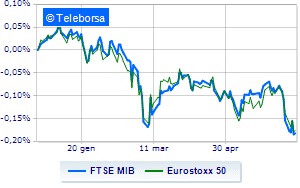

The Milanese list shows a timid gain, with the FTSE MIB which is achieving + 0.58%; along the same lines, the FTSE Italia All-Share proceeds in small steps, advancing to 23,956 points.

Slightly negative the FTSE Italia Mid Cap (-0.25%); fractional earnings for the FTSE Italia Star (+ 0.67%).

Between best Italian stocks large-cap, it shines Banco BPMwith a strong increase (+ 3.65%).

Excellent performance for Telecom Italiawhich records a progress of 2.98%.

Exploit of Unicreditwhich shows an increase of 2.60%.

High Intesa Sanpaolo (+ 2.41%).

The strongest sales, on the other hand, show up on Nexiwhich continues trading at -3.38%.

Sales focus on A2Awhich suffers a 2.46% decline.

Goes down Saipemwith a fall of 2.24%.

Sales on DiaSorinwhich recorded a decline of 1.22%.

Top of the ranking of mid-cap stocks from Milan, Reply (+ 5.68%), doValue (+ 3.26%), Fincantieri (+ 2.89%) e Safilo (+ 2.03%).

The strongest falls, on the other hand, occur on De ‘Longhiwhich continues the session with -10.18%.

Collapses Buzzi Unicemwith a decrease of 2.57%.

Sales hands on Ariston Holdingwhich suffers a decrease of 2.18%.

Bad performance for BFwhich recorded a decline of 2.11%.

Among macroeconomic appointments which will have the greatest influence on market trends:

Monday 20/06/2022

08:00 Germany: Production prices, monthly (expected 1.5%; previous 2.8%)

08:00 Germany: Production prices, annual (expected 33.5%; previous 33.5%)

Tuesday 21/06/2022

4:00 pm USA: Sale of existing homes, monthly (previous -2.4%)

Wednesday 22/06/2022

08:00 United Kingdom: Production prices, annual (previous 14%)

08:00 United Kingdom: Consumption prices, monthly (expected 0.6%; previous 2.5%).