(Finance) – Purchases widespread on European stock exchanges and in Milanwhich they put behind them indications arrived from the ECB, which ruled out the possibility of imminent rate cuts in the EU. The more interest it arouses the data on US inflationout today, which will be read in the light of Fed meeting lsee you next week.

L’Euro / US Dollar maintains the position essentially stable at 1.086. Substantially stable thegold, which continues the session at the levels of the day before at 2,021.9 dollars an ounce. Oil (Light Sweet Crude Oil) continues the session just below parity with a negative change of 1.03%.

Slight improvement of spreadwhich drops to +154 basis points, with a drop of 2 basis points, while the yield on the 10-year BTP stands at 3.78%.

Among the markets of the Old Continent flat Frankfurtwhich holds parity, in light Londonwith a large advance of 1.08%, and effervescent Pariswith an increase of 1.99%.

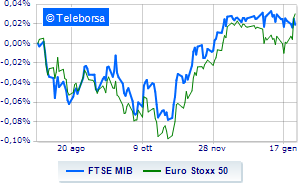

The Milanese price list shows a timid gain, with the FTSE MIB which is achieving +0.53%; along the same lines, the FTSE Italia All-Share advances fractionally, reaching 32,488 points.

Almost unchanged FTSE Italia Mid Cap (+0.13%); slightly positive FTSE Italia Star (+0.47%).

Between best Italian shares large-cap, red-hot Monclerwhich boasts a significant increase of 5.78%.

In the foreground Brunello Cucinelliwhich shows a strong increase of 4.84%.

Take off Campariwith an important progress of 4.34%.

Positive trend for Ferrariwhich advances by a discreet +1.96%.

The worst performances, however, are recorded on STMicroelectronicswhich gets -2.77%.

Negative session for MPS Bankwhich shows a loss of 2.51%.

Under pressure BPERwhich suffered a decline of 1.62%.

Basically weak BPM deskwhich recorded a decline of 0.86%.

At the top among Italian shares a mid-cap, Ferragamo (+6.97%), GVS (+5.60%), Juventus (+2.94%) e Saint Lawrence (+1.93%).

The strongest sales, however, occur at De’ Longhiwhich continues trading at -4.05%.

It slides Technoprobewith a clear disadvantage of 2.26%.

In red Saraswhich highlights a sharp decline of 1.57%.

It moves below parity D’Amicohighlighting a decrease of 1.25%.