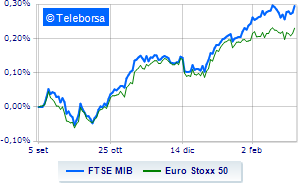

(Tiper Stock Exchange) – Shopping is rampant in Europe, thanks to the positive news from the macroeconomic front: in Europe, economic activity reached an 8-month high in February. A decidedly positive balance also in Piazza Affari and on Wall Street, with theS&P-500 which boasts a progress of 0.99%.

On the foreign exchange market, theEuro / US Dollar it is substantially stable and stops at 1.06. L’Gold shows a modest gain, with an increase of 0.49%. Positive session for oil (Light Sweet Crude Oil), which shows a gain of 1.16%.

Downhill it spreadswhich retreats to +175 basis points, with a decrease of 5 basis points, while the 10-year BTP reports a yield of 4.44%.

Among the main European Stock Exchanges effervescent Frankfurtwith an increase of 1.64%, substantially unchanged Londonwhich reports a moderate +0.04%; Paris advances by 0.88%. In Milan, the FTSEMIB (+1.56%), which reaches 27,825 points; along the same lines, the FTSE Italia All-Share gains 1.46% compared to the previous session, closing at 30,086 points.

On the Milan Stock Exchange, the exchange value in today’s session it amounted to 1.87 billion euros, down by 334.5 million euros, compared to 2.21 billion on the previous day; volumes stood at 0.51 billion shares, up from 0.49 billion previously.

At the top of the ranking of the most important titles of Milan, we find Inwit (+8.17%), amplifier (+6.73%), Prysmian (+4.29%) and Ferrari (+3.18%).

The worst performances, however, were recorded on Saipemwhich closed at -2.15%.

At the top of the mid-cap rankings from Milan, Maire Tecnimont (+7.01%), Illimity Bank (+3.70%), GV extension (+3.70%) and Dry (+3.53%).

The strongest sales, however, fell on Piaggiowhich finished trading at -4.38%.

Thump of Brembowhich shows a fall of 4.07%.

Decided decline for Antares Visionwhich marks a -3.12%.

Under pressure Ariston Holdingwith a sharp drop of 2.63%.

Among the data relevant macroeconomics:

Friday 03/03/2023

00:30 Japan: Unemployment rate (expected 2.5%; previous 2.5%)

02:45 China: Caixin Services PMI (exp. 54.7 points; previous 52.9 points)

08:00 Germany: Trade balance (expected 11 billion euros; previous 10 billion euros)

08:45 France: Industrial Production, Monthly (exp. 0.1%; previous 1.5%)

10am European Union: PMI services (expected 53 points; previous 50.8 points).