(Finance) – Sitting no for the Milan Stock Exchange, which did worse than other European markets, on a day characterized by generally negative weather. Positive balance for the American stock market, where theS & P-500 boasts a progress of 0.56%, after the Fed chairman, Jerome Powellbefore speaking to the Senate, he stressed that the central bank is “totally focused” on getting inflation back to the 2% target. In a report to Congress, the Fed then promised an “unconditional” commitment to restore price stability, necessary to sustain a strong labor market. “

The trend in European equities was affected by the sharp drop in oil, with concerns of an economic slowdown in the United States, the largest consumer of crude oil in the world. Also impacting are the efforts of the White House to bring down fuel prices, amid record profits recorded by oil companies, with the US administration studying a temporary suspension of the federal gasoline tax.

On the currency market, theEuro / US dollar trading continues with a fractional gain of 0.59%. L’Gold trading continues with a fractional gain of 0.43%. Oil (Light Sweet Crude Oil) collapsed by 4.51%, falling as low as $ 105.7 per barrel.

The Spread it takes a small step downwards, with a decrease of 1.06% to +191 basis points, while the yield of the 10-year BTP stands at 3.53%.

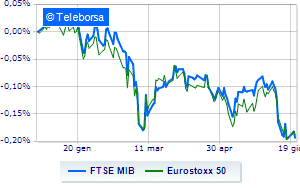

Among the Euroland indices suffers Frankfurtwhich shows a loss of 1.11%, prey to the sellers London, with a decrease of 0.88%; they focus their sales on Paris, which suffers a decline of 0.81%. Minus sign in closing for the Milanese list, in a session characterized by large sales, with the FTSE MIB which accuses a decrease of 1.36%, interrupting the series of three consecutive increases, which began last Friday, while, on the contrary, a slight increase for the FTSE Italia All-Sharewhich brings us to 24,132 points.

In the Milan Stock Exchange it appears that the exchange value in today’s session it amounted to € 1.53 billion, an increase compared to the previous session’s 1.42 billion; while the volumes traded today went from 0.42 billion shares of the previous session to today’s 0.42 billion.

At the top of the ranking of the most important titles of Milan, we find Fineco (+ 2.63%), Nexi (+ 2.31%), Amplifon (+ 1.37%) e Inwit (+ 1.20%).

The strongest declines, on the other hand, occurred on Saipemwhich closed the session at -21.56%, after the board of directors of the services and solutions company for the energy and infrastructure sector resolved to increase the share capital indivisibly by an amount of 2 billion euros and approved the final terms and conditions of the same.

Letter on Tenariswhich records a significant decline of 5.16%.

Goes down Italgaswith a fall of 3.75%.

Sales on ENIwhich recorded a decline of 3.48%.

At the top among Italian stocks a mid cap, Wiit (+ 2.50%), Reply (+ 2.21%), Sesa (+ 2.19%) e Tinexta (+ 2.08%).

The worst performances, however, were recorded on De ‘Longhiwhich closed at -3.73%.

Collapses Danieliwith a decrease of 3.52%.

Sales hands on Antares Visionwhich suffers a decrease of 2.63%.

Bad performance for Mutuionlinewhich recorded a decline of 2.57%.

Among macroeconomic appointments which will have the greatest influence on market trends:

Wednesday 22/06/2022

08:00 United Kingdom: Production prices, annual (expected 14.7%; previous 14.7%)

08:00 United Kingdom: Consumption prices, monthly (expected 0.6%; previous 2.5%)

08:00 United Kingdom: Consumption prices, yearly (9.1% expected; 9% before)

08:00 United Kingdom: Production prices, monthly (expected 1.5%; previous 2.2%)

4:00 pm European Union: Consumer confidence (expected -20.5 points; prev. -21.2 points).