(Finance) – Milan is weakin the wake of the other Eurozone stock exchanges in the aftermath of the ECB’s decision which, as expected, left rates unchanged. Still on the central banks front, today the Russian Bank has decided to raise rates key by two percentage points, bringing them from 13 to 15 percent. Substantially stable theS&P-500 on the American market, which marks a percentage change of +0.17%, while the quarterly season on both sides of the Atlantic.

Slight increase forEuro / US Dollar, which shows an increase of 0.29%. Slight decline ingold, which falls to 1,979.3 dollars an ounce. Oil (Light Sweet Crude Oil), increasing (+0.92%), reaches 83.98 dollars per barrel.

It is reduced slightly spreadwhich reaches +196 basis points, with a slight decrease of 2 basis points, while the yield on the 10-year BTP stands at 4.80%.

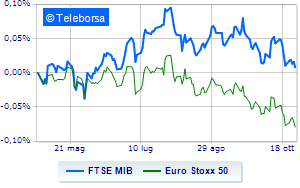

Among the European price lists he hesitates Frankfurtwith a modest decline of 0.30%, sales are concentrated on Londonwhich suffers a decline of 0.86%, and sales up Paris, which recorded a decline of 1.36%. In Piazza Affari, the FTSE MIB it is decreasing (-0.8%) and stands at 27,287 points at closing; on the same line, closes in reverse FTSE Italia All-Sharewhich slips to 29,029 points.

At the close of the Milan Stock Exchange, the exchange value in the session of 10/27/2023 it was equal to 2.07 billion euros, a marked decrease (-14.85%), compared to the previous session which had seen the negotiation of 2.43 billion euros; while the volumes traded went from 0.77 billion shares in the previous session to 0.53 billion.

Among the best Blue Chips of Piazza Affari, revved up Saipem (+3.93%).

Moderate earnings for Finecowhich advances by 1.47%.

Small steps forward for Unicreditwhich marks a marginal increase of 1.12%.

Moderately positive day for MPS Bankwhich rises by a fractional +1.04%.

The worst performances, however, were recorded on Monclerwhich closed at -6.46%.

Bad performance for Amplifonwhich recorded a decline of 4.02%.

Negative session for STMicroelectronicswhich shows a loss of 3.73%.

Under pressure Nexiwhich suffered a decline of 2.50%.

At the top among Italian shares a mid-cap, Saras (+4.86%), De’ Longhi (+4.84%), Antares Vision (+4.23%) e Saint Lawrence (+3.02%).

The worst performances, however, were recorded on Buzzi Unicemwhich closed at -2.74%.

It slides Danieliwith a clear disadvantage of 2.58%.

In red MFE Bwhich highlights a sharp decline of 2.05%.

The negative performance of UnipolSaiwhich fell by 2.04%.