(Finance) – Excellent performance for MFE Awhich closed trading up by 7.17%, while class B shares showed an increase of 6.18%. The stock of the Cologno Monzese company benefits from the solid results presented by the Group, which highlights a profit for the 9 months at 71 million euros and revenues of 1.862 billion (-2%). Ebit increased slightly to 98.3 million and positive free cash flow of 285.8 million

In a conference call with the general manager of marketing of Publitalia ’80, Matteo Cardani, said that i advertising revenues in Italy in the first 11 months they are estimated to grow by 1-1.5% every year.

Mediaset CFO Marco Giordano assured “we confirm our dividend policy”, remembering that the goal is to distribute at least 50% of the profit, regardless of the contribution of Prosieben’s participation to the result.

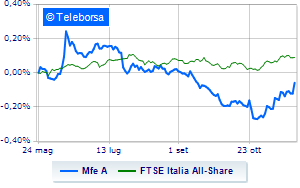

On a comparative level on a weekly basis, the trend of Italian media and communications company highlights a more marked trend than the trendline of FTSE Italia All-Share. This demonstrates the greater propensity of investors to buy towards MediaForEurope compared to the index.

Signs of strengthening for the short-term trend with more immediate resistance seen at 2.218 Euros, with a support level controlling the current phase estimated at 2.048. The balanced bullish strength of MFE A it is supported by the upward crossing of the 5-day moving average over the 34-day moving average. Due to the technical implications assumed, we should see a continuation of the bullish phase towards 2.388.