(Tiper Stock Exchange) – MARR communicated thelaunch of a treasury share buyback programme for a total maximum number of 3,300,000 shares.

The buyback program is aimed at:

a) carry out, directly or through intermediaries, any investment transactions also to contain anomalous movements in quotations, to regularize the trend of trading and prices and to support the liquidity of the security on the market, so as to favor the regular conduct of trading at the outside the normal variations linked to market trends, without prejudice in any case to compliance with current provisions;

b) carry out, in line with the Company’s strategic guidelines, capital transactions or other transactions in relation to which it is necessary or appropriate to proceed with the exchange or sale of share packages to be carried out by means of exchange, transfer or other act of disposal.

The Program will last until the date of the shareholders’ meeting to approve the financial statements closed on 31 December 2023, with the possibility of subsequent extensions in compliance with the maximum period of 18 months authorized by the shareholders’ meeting. The buyback activities may also be carried out only partially and the Board of Directors may suspend them at any time.

As at 12 May, MARR held a total of 557,210 treasury shares in its portfolio, equal to 0.84% of the share capital.

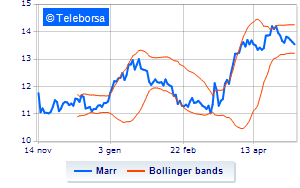

In Piazza Affari, today, fractional discount for MARRwhich closed the trades with a loss of 0.59%.