(Finance) – Milan is weak, in the wake of the other Euroland stock exchanges, at the end of a day that saw the rekindling of tensions due to the Ukrainian crisis, between explosions in the separatist republics in the east of the country and the announcement of Russian nuclear military exercises tomorrow. The performance of Wall Street was also weak, with theS & P-500 which recorded a decrease of 0.48%.

On the currency market, sitting fractionally lower due to theEuro / US dollar, which for now leaves 0.25% on the parterre. L’Gold maintains a broadly stable position at $ 1,896 an ounce. Oil (Light Sweet Crude Oil) continued the session just below par with a negative change of 0.59%.

Slight worsening of the spreadwhich rises to +163 basis points, with an increase of 2 basis points, with the yield of the 10-year BTP equal to 1.84%.

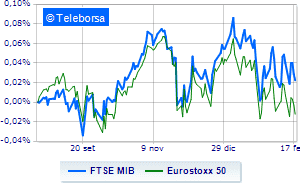

Among the markets of the Old Continent slips Frankfurtwith a distinct disadvantage of 1.47%, subdued London showing a 0.32% filing; disappointing Paris, which lies just below the levels of the eve. Caution prevails in closing in Piazza Affari, with the FTSE MIB which closes the session with a slight decrease of 0.61%; on the same line, with a slight decrease on FTSE Italia All-Sharewhich puts the day under par at 28,888 points.

At the close of the Milan Stock Exchange, the exchange value in today’s session it was equal to 2.05 billion euro, a marked decrease (-19.19%), compared to the previous session which had seen the negotiation of 2.54 billion euro; while the volumes traded went from 0.68 billion shares of the previous session to today’s 0.47 billion.

Among the best Blue Chips of Piazza Affari, well set up Banco BPM, which shows an increase of 1.88%. Among other banks, toned Fineco which shows a nice advantage of 1.04%.

In light ENIwith a large increase of 1.02%.

Moderate earnings for Recordatiwhich is up by 0.85%.

The worst performances, however, were recorded on DiaSorinwhich closed at -2.86%.

In red Nexiwhich shows a marked drop of 2.34%.

Letter on STMicroelectronicswhich records a significant decline of 2.25%.

The negative performance of Buzzi Unicemwhich falls by 1.97%.

Top of the ranking of mid-cap stocks from Milan, Autogrill (+ 4.73%), doValue (+ 4.65%), Banca Popolare di Sondrio (+ 2.02%) e Bff Bank (+ 1.83%).

The strongest declines, on the other hand, occurred on GVSwhich closed the session at -4.00%.

Goes down Brembowith a fall of 3.02%.

Collapses Saraswith a decrease of 2.97%.