(Finance) – Final bearish for the main European stock exchanges where the Silicon Valley Bank’s troubles they were also reflected in the stocks of European banks, due to investor fears for the entire sector.

Heavy declines also in the Piazza of Milan where, however, the shares of Leonardo And Buzzi. For Alessandro Profumo, CEO of the defense group, the company is more resilient and “ready to seize new opportunities”. The second, the company active in the production of cement, has rejected the allegations of the Ukrainian authorities and explained that it has no involvement in the Russian subsidiary.

On the foreign exchange market, theEuro / US Dollar trading continues at 1.067 Euro / US Dollar, an increase of 0.78%. Strong earnings day forgold, which marks an increase of 1.64%. Oil (Light Sweet Crude Oil) continues trading, with an increase of 1.44%, to 76.81 dollars per barrel.

Uphill it spreadswhich reaches +172 basis points, with an increase of 5 basis points, with the yield of the 10-year BTP equal to 4.19%.

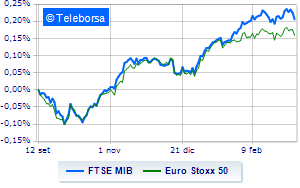

Among the indices of Euroland under pressure Frankfurtwith a sharp drop of 1.31%, bad performance for Londonwhich records a drop of 1.67%: it suffers Paris, which shows a loss of 1.30%. At peak Piazza Affari at the end of the session, with the FTSEMIB which suffers a decrease of 1.55%; along the same lines, bad day for the FTSE Italia All-Sharewhich closes the session at 29,941 points, down by 0.72%.

At the close of Milan it appears that the exchange value in today’s session it amounted to 2.22 billion euros, with an increase of 12.72%, compared to the previous 1.97 billion euros; while the volumes traded went from 0.54 billion shares in the previous session to today’s 0.55 billion.

Between best performers of Milan, in evidence Buzzi Unicem (+2.99%), Leonardo (+2.85%), Italgas (+1.65%) and Moncler (+0.84%).

The strongest sales, however, fell on Phinecuswhich finished trading at -4.58%.

Black session for BPERwhich leaves a loss of 4.47% on the table.

At a loss Prysmianwhich drops by 4.28%.

Prey of sellers CNH Industrialwith a decrease of 3.90%.

At the top among Italian stocks a mid-cap, MARR (+1.07%), Danieli (+0.61%), Illimity Bank (+0.53%) and Luve (+0.51%).

The strongest sales, however, fell on Carel Industrieswhich finished trading at -5.05%.

Heavy El.Enwhich marks a drop of -4.97 percentage points.

Bad sitting for Tinextawhich drops by 3.91%.

They focus their sales on Technogymwhich suffers a drop of 3.50%.

Among the data relevant macroeconomics:

Friday 03/10/2023

00:30 Japan: Real household expenditure, monthly (expected 1.4%; previous -2.1%)

00:50 Japan: Production prices, monthly (expected -0.3%; previous 0%)

08:00 Germany: Consumption prices, annual (expected 8.7%; previous 8.7%)

08:00 Germany: Consumption prices, monthly (expected 0.8%; previous 1%)

08:00 United Kingdom: Industrial Production, Monthly (exp. -0.1%; previous 0.3%).