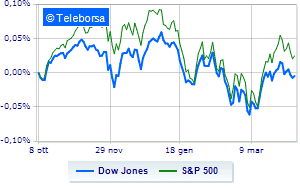

(Finance) – Wall Street moves downwith the Dow Jones which is leaving 0.20% on the parterre; on the same line, theS & P-500 it has a depressed trend and is trading below the levels of the eve of 4.469 points. The Nasdaq 100 (-0.67%); on the same trend, in fractional decline theS&P 100 (-0.31%). The focus is always on the choices of the Fed and on the words of the central bankers. Minutes released last night showed Fed officials “generally agreed” to cut up to $ 95 billion a month from central bank assets, even as the war in Ukraine has mitigated the first hike in US interest rates since 2018. The president of the St. Louis FED, James Bullardmeanwhile, stated that the Federal Reserve may need to raise interest rates to around 3.5% to counteract too high inflation and that therefore “the current policy rate is around 300 basis points too low” .

Noticeable upside in the S&P 500 for i compartments sanitary (+ 1.76%) e consumer goods for the office (+ 0.97%). In the lower part of the S&P 500 ranking, significant falls are manifested in the sectors telecommunications (-1.47%), financial (-0.91%) e secondary consumer goods (-0.86%).

“There is really nothing to support the markets probably between now and earnings season – said Anastasia Amoroso, iCapital’s chief investment strategist – The awareness continues for investors that the FED is not yet at the top of the hawkish attitude and in this context, it is really a struggle for the performance of the shares. “

At the top of the ranking of American giants components of the Dow Jones, Merck (+ 2.45%), Procter & Gamble (+ 1.28%), McDonald’s (+ 1.17%) e Wal-Mart (+ 1.14%).

The worst performances, on the other hand, are recorded on Visawhich gets -2.10%.

Negative sitting for DOWwhich shows a loss of 1.83%.

Under pressure Boeingwhich shows a decrease of 1.69%.

It slips Honeywell Internationalwith a clear disadvantage of 1.61%.

Between protagonists of the Nasdaq 100, Costco Wholesale (+ 3.68%), Idexx Laboratories (+ 2.60%), O’Reilly Automotive (+ 2.60%) e Zscaler (+ 2.22%).

The worst performances, on the other hand, are recorded on Pinduoduo Inc Spon Each Repwhich gets -7.27%.

Collapses Lucidwith a decrease of 4.55%.

Sales hands on JD.comwhich suffers a decrease of 3.90%.

Bad performance for Baiduwhich recorded a decline of 3.66%.