The situation seems paradoxical: inflation is weighing on their purchasing power, but the French are filling their woolen stockings more and more. According to the Banque de France, the savings rate thus reached 16.3% of income in the third quarter of 2022, against 15% three years earlier, just before the Covid epidemic. “With the war in Ukraine and economic uncertainties, the fear of tomorrow encourages people to put money aside”, analyzes Philippe Crevel, director of the Cercle de l’Epargne.

The Livret A account illustrates the growing appetite of the French for savings since its outstanding amount reached a record level of 384.7 billion euros in January 2023 thanks to a massive collection of more than 9 billion euros in this month alone. . Savers literally flocked to this old-fashioned product, which was created in 1818. It is true that the return was multiplied by 6 in one year, going from 0.5% to 3%. The rate is set by Bercy according to a calculation formula taking into account the level of inflation and short-term interest rates, themselves indirectly linked to the key rates of the European Central Bank (ECB). Two indicators up sharply since inflation was 6.3% in France on an annual basis in February, while the ECB raised its key rate to 3% in March.

“The right strategy consists in filling in priority its booklet A and its booklet of sustainable and united development (LDDS), because they are the best investments without risk of the market”, estimates Maxime Chipoy, the president of Moneyvox. Only the popular savings account (LEP) does better, at 6.1%, but it is reserved for low-income households subject to income conditions. Attention: the booklet A and the LDDS both bring in 3%, but the first is capped at 22,950 euros and open to all, while the second is reserved for taxpayers (which excludes minors attached to their parents’ tax household) and can only collect 12,000 euros. These two regulated booklets are also exempt from taxes and social charges. A major advantage. “It makes sense to invest the equivalent of three to four months’ income in risk-free investments to be able to meet an unforeseen expense, but no more because they bring in less than inflation”, notes Maxime Chipoy, however. .

The detail of precautionary savings.

© / The Express

The trail of tax booklets

Indeed, savers become poorer by placing their cash in a 3% passbook A, when the price increase is around 6%, but this is always better than letting these sums lie dormant in an unpaid current account. It remains to be seen what the government will decide on the next revision of the passbook rate on August 1st. “The calculation formula should argue for a further increase in yield to 3.5% because inflation has continued to rise in recent months, but it is likely that Bercy will rather opt for a status quo in order to anticipate the ebb of the rise in prices that will occur in the second half”, analyzes Philippe Crevel.

The livret A and the LDDS are not always enough to invest your money without risk, especially when you have several tens of thousands of euros, for example after an inheritance. If you are looking for a secure investment for a few months, the time to find a long-term destination (purchase of real estate, life insurance, retirement savings, etc.), you should then be interested in the tax savings accounts offered by the banks. Let’s cut short all hope: none comes close to the Livret A. On average, the bank books yielded 0.50% in February 2023, according to the Banque de France. And again, you have to deduct 30% of the single tax levy (or, optionally, the income tax on the progressive scale, the social security contributions still due) to obtain the net remuneration, ie 0.35%. Ten times less than the booklet A! The only advantage of bank books is their virtual absence of ceiling, since it is most often possible to pay up to… 10 million euros.

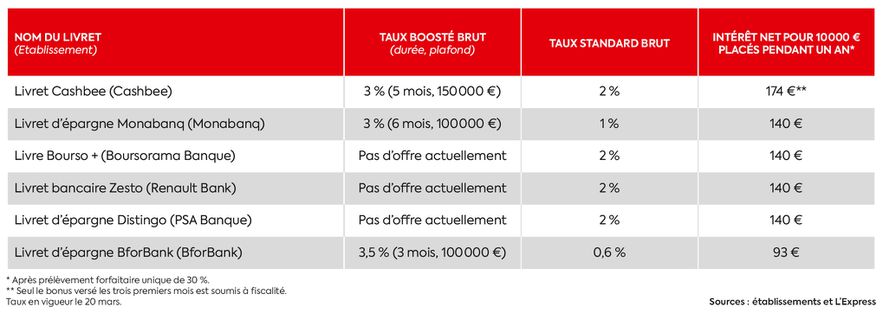

Some booklets, however, show a much more attractive rate, in particular thanks to promotions offering a boosted return for a few months to new customers. This is the case of the Cashbee booklet, offered in partnership with My Money Bank, which yields 3% over the first five months, then 2%, for a net return of 1.74% the first year. It’s better than elsewhere, but well below the regulated booklets. “Promotional offers are multiplying, but we must not stop at the rate of the first months: what matters is the standard return once the bonus period is over”, specifies Marc Tempelman, co-founder of the Cashbee app. .

The car manufacturers’ banks, Renault Bank and PSA Banque, display standard rates at 2%, as does Boursorama Banque, whose savings account is however capped at 30,000 euros. “We regularly offer promotional offers for new arrivals, but we must not forget our historical customers,” says Sarah Zamoun, head of Distingo at PSA Banque. “We also make loyalty offers for their new payments”. To watch, therefore.

The return of term deposits

It is also possible to place your precautionary savings in a term account. In this case, unlike the livret A, the LDDS and the bank books, the customer agrees to block his savings for a period originally set, often from one to three years. In return, he receives a slightly higher salary. Having fallen into disuse in recent years in a context of low yields, term accounts have been making a comeback for a few months. PSA Banque thus offers three products with an annual rate of 2.6% for one year, 2.7% for two years and 2.8% for three years. As with bank books, interest is subject to the single tax levy of 30%. “The “one-year” term account benefits from 0.6 additional point of remuneration compared to the Distingo booklet, a difference which rewards the customer’s commitment to holding over the long term”, explains Sarah Zamoun.

For its part, Boursorama Banque offers a remuneration of 3% gross over 12 months, for a minimum payment of 30,000 euros. This is one point more than his bank book (2%). Savers who are certain of not needing this money for the next twelve months therefore have more interest in taking out a term account than a passbook. But beware: the online bank specifies that in the event of withdrawal before the due date, no interest will be paid.

LEP, big winner

The popular savings account (LEP) is undoubtedly the most profitable risk-free investment on the market: since February 1, 2023, it has yielded 6.1%, while being exempt from taxes and social security contributions. It is therefore the only risk-free product capable of preserving purchasing power.

However, not everyone can benefit from it since it is reserved for low-income families. To open a LEP in 2023, you must have declared a reference tax income of less than 21,393 euros for the year 2021 for a single person or 38,530 euros for a couple with a child – these amounts appear on your notice tax 2022. Theoretically, it is up to the bank to check with the tax authorities if its client is eligible, but in practice, establishments often ask interested parties to present their tax form.

“Inflation should gradually decrease to 5% this summer, notes Maxime Chipoy, president of MoneyVox. The LEP rate should therefore be revised downwards on August 1, probably around 5.7%”. A level that remains attractive and invites you to pay a maximum on this booklet capped at 7,700 euros.