(Finance) – The main markets of Euroland are in positive territory. On the same bullish trail, the Piazza Affari session is closed. Positive balance for the American stock market, where theS & P-500 boasts a progress of 0.64%.

Plus sign forEuro / US dollar, which shows an increase of 0.76%. Plus sign forgold, which shows an increase of 1.25%. Heavy oil purchases (Light Sweet Crude Oil), showing a 1.32% gain.

Salt a lot spreadreaching +204 basis points, with a marked increase of 14 basis points, while the 10-year BTP has a yield of 3.27%.

Among the Euroland indices in light Frankfurtwith a large progress of 1.01%, closed London for the Platinum Jubilee Bank Holiday with a sharp drop of 0.98%, and a positive trend for Pariswhich is up by a decent + 1.27%.

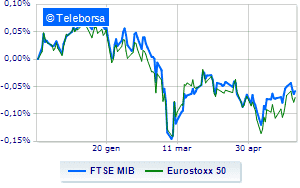

The Milanese price list shows a timid gain in closing, with the FTSE MIB which scored a + 0.59%; on the same line, slight increase for FTSE Italia All-Sharewhich brings to 26,691 points.

In fractional progress the FTSE Italia Mid Cap (+ 0.53%); on the same line, in cash the FTSE Italia Star (+ 0.77%).

On the Milan Stock Exchange, the turnover in today’s session was equal to 1.15 billion euro, down by 826.2 million euro, compared to 1.97 billion on the previous day; volumes stood at 0.36 billion shares, compared with the previous 0.56 billion.

Of the 409 stocks traded, 179 shares closed today’s session in progress, while 222 closed lower. The remaining 8 titles remain unchanged.

Between best performers of Milan, in evidence Moncler (+ 3.05%), Interpump (+ 2.83%), DiaSorin (+ 2.61%) e Iveco Group (+ 2.47%).

The strongest declines, on the other hand, occurred on Saipemwhich closed the session at -1.85%.

Suffers A2Awhich shows a loss of 1.07%.

Modest descent for Herawhich yields a small -0.82%.

At the top among Italian stocks a mid cap, OVS (+ 3.77%), Juventus (+ 3.27%), Danieli (+ 3.23%) e Safilo (+ 3.14%).

The worst performances, however, were recorded on Wiitwhich closed at -3.40%.

Prey of the sellers Credemwith a decrease of 1.47%.

Sales focus on Carel Industrieswhich suffers a decrease of 1.35%.

Sales on Rai Waywhich recorded a decrease of 1.31%.