(Tiper Stock Exchange) – Little moved sitting on Wall Streetafter the Bank of Japan’s surprise decision to allow long-term interest rates to rise. Persist i fears that the Federal Reserve could plunge the economy into a recession Next year. Last week, the US central bank raised its key interest rate by 50 basis points and policymakers indicated that the terminal rate could go up to 5.1%.

L’macroeconomic agenda today is rather empty. The only interesting data are those on real estate market, from which came negative news: both building permits and the openings of new construction sites decreased in November. However, the most important data will arrive on Friday and it is the PCE inflation deflator, considered “the preferred measure of the FED”.

On the front of quarterly, General Mills (one of the most important US multinationals active in the production of food) has improved outlook for the full fiscal year thanks to price increases and resilient demand. FactSet (global provider of financial information) reported higher quarterly revenues, thanks in part to the acquisition of CUSIP Global Services (CGS).

However, investors are waiting for the quarterly reports of some giants to get signals on the trend of the US economy. Particularly, FedEx and Nike they will publish i results after today’s close of the market.

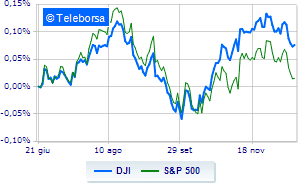

The Dow Jones it advances to 32,887 points, breaking the series of four consecutive declines, which began last Wednesday; on the same line, small leap forward for theS&P-500, which comes in at 3,827 points. Almost unchanged NASDAQ 100 (+0.02%); on the same trend, on the levels of the previousS&P 100 (+0.19%).

Between protagonists of the Dow Jones, boeing (+1.38%), Travelers Company (+1.34%), IBM (+1.19%) and Walgreens Boots Alliance, (+1.16%).

The strongest declines, however, occur on intel, which continues the session with -0.94%. Slow day for Home Depot, which marks a decrease of 0.62%. Small loss for 3Mwhich trades with -0.58%.

To the top between Wall Street tech giantsthey position themselves Modern (+5.68%), Adobe Systems (+2.95%), AirBnb (+2.68%) and Lucid Group, (+2.32%).

The strongest declines, however, occur on Tesla Motors, which continues the session with -5.42%. Slide Baidu, with a clear disadvantage of 3.12%. In red NetEase, which shows a marked decrease of 2.56%. The negative performance of Gilead Sciences,which drops by 2.51%.