(Finance) – A modest start for the Wall Street stock exchange, after the rising session the day before, when the data on producer prices of August, confirmed that inflation is higher than expected, reiterating what emerged the day before from the consumer prices.

Insiders are now looking ahead to the Federal Reserve’s monetary policy meeting scheduled for next week, while the chances among experts that the American central bank will increase interest rates in November are reduced. Expectations for the next quarter are that the Fed will keep rates at 5.25%-5.5%, the highest level in the last 22 years.

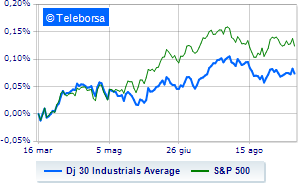

Among US indices, the Dow Jones stands at the values of the day before at 34,866 points, while, on the contrary, theS&P-500, which relegates to 4,487 points. In fractional decline the Nasdaq 100 (-0.51%); on the same line, just below parity theS&P 100 (-0.35%).

In the S&P 500, no fund is saved. In the list, the worst performances are those of the sectors informatics (-0.70%), power (-0.67%) e secondary consumer goods (-0.48%).

To the top between giants of Wall Street, Goldman Sachs (+2.86%), Walgreens Boots Alliance (+2.65%), Caterpillar (+2.41%) e Dow (+2.31%).

The worst performances, however, are recorded on Visawhich gets -2.55%.

Between best performers of the Nasdaq 100, Sirius XM Radio (+4.10%), Modern (+3.89%), Align Technology (+3.24%) e Paccar (+3.11%).

The worst performances, however, are recorded on DexComwhich gets -3.49%.

He suffers Netflixwhich highlights a loss of 2.85%.

Prey for sellers Old Dominion Freight Linewith a decrease of 2.11%.

Undertone Advanced Micro Devices which shows a 1.00% filing.