(Finance) – Weak session on Wall Street, which is preparing to end the week with the greatest gains in almost a month. To pull the American stock market from Monday were the growth stocksafter the positive reaction to the results of Tesla And Netflix. In fact, investors continue to evaluate the quarterly reports of large companies to obtain indications on the trend of the economy. Focus on social media headlines after the collapse of Snapwhich reported a loss of $ 422 million for the quarter, as well as slower sales growth, adding that it will “substantially” cut hiring.

Between companies that have released quarterly reports today there are: Twitter released below-expected results, blaming the pending acquisition of Elon Musk and the decline in advertising for disappointing revenue performance. Verizon revised its full-year guidance downward following the slowdown in new customers in the second quarter. AmEx increased its revenue outlook thanks to the strong rebound in travel and entertainment spending in the first half of the year.

On the macroeconomic front, investors find themselves evaluating the Purchasing Managers Index (PMI) in the manufacturing, services and composite sectors for the month of July.

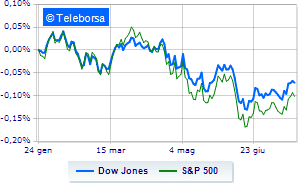

The US price lists show a shy gainwith the Dow Jones which is achieving + 0.43%, consolidating the series of four consecutive increases, started last Tuesday, while, on the contrary, theS & P-500, with the prices reaching 4.007 points. Consolidate eve levels on Nasdaq 100 (-0.05%); as well, on parity theS&P 100 (+ 0.09%).

Featured on the North American S&P 500 i price list compartments power (+ 1.05%), secondary consumer goods (+ 0.96%) e utilities (+ 0.86%). At the bottom of the ranking, significant falls are manifested in the sector telecommunicationswhich reports a decrease of -1.74%.

To the top between giants of Wall Street, American Express (+ 5.61%), Walgreens Boots Alliance (+ 1.53%), Home Depot (+ 1.21%) e Honeywell International (+ 0.87%).

The worst performances, on the other hand, are recorded on Verizon Communicationwhich gets -5.51%.

Suffers Intelwhich shows a loss of 1.42%.

He hesitates IBMwhich yields 0.54%.

To the top between tech giants of Wall Streetthey position themselves Constellation Energy (+ 2.51%), Marriott International (+ 2.36%), Datadog (+ 2.08%) e Tesla Motors (+ 2.06%).

The strongest falls, on the other hand, occur on Intuitive Surgicalwhich continues the session with -5.83%.

Negative sitting for Meta Platformswhich falls by 4.54%.

Sensitive losses for Align Technologydown 3.78%.

Breathless Micron Technologywhich falls by 2.53%.

Between macroeconomic variables most important in the North American markets:

Friday 22/07/2022

15:45 USA: PMI services (expected 52.6 points; preceding 52.7 points)

15:45 USA: Composite PMI (preceding 52.3 points)

15:45 USA: Manufacturing PMI (expected 52 points; preceding 52.7 points)

Tuesday 26/07/2022

15:00 USA: FHFA house price index, monthly (previous 1.6%)

15:00 USA: S&P Case-Shiller, annual (previous 21.2%).