(Finance) – Results in line with expectations, but without positive surprises, and above all an unchanged guidance. So Leonardo left a bad taste in the mouth of those who expected, in particular, an upward update of the outlook in light, for example, of the maxi contract in Poland announced at the beginning of the month, with a gross value of 8.25 billion zlotys. (€ 1.76 billion).

The title Leonardo closed today’s session in sharp decline with a -7.64%, after starting trading this morning with a first price at 9.7 Euro, above yesterday’s lower level, and then losing strength during the meeting, with analysts who welcomed the quarterly results announced yesterday with markets closed. The group closed the first half of 2022 with net income up 50.8% to 267 million euros with revenues up 3.6% to 6.6 billion and orders for 7.3 billion (+9.4 %).

L’managing director Alessandro Profumo confirmed the 2022 guidance speaking of “solid results, with the improvement of all indicators”. Yet the stock fell to the lows of the day: analysts expected more.

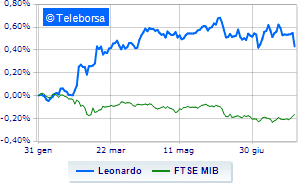

The technical scenario seen at one week of the stock compared to the index, highlights a slowdown in the trend of Italian holding company in the aeronautics sectors compared to FTSE MIBand this makes the stock a potential target for sale by investors.

New technical evidence classifies a worsening of the situation for Leonardo, with potential drops to the most immediate support area seen at 8.884. Sudden strengthening would instead undermine the above scenario with a bullish trigger and target on the most immediate resistance identified at 9.64. Expectations for the next session are for a continuation of the downside to the important support positioned at 8,632.

The trend of Italian contractor in the defense sector it appears to be rather stable in the last period, with a decidedly contained level of daily volatility at 2.183. The daily volumes, equal to 13,548,440, are higher than the one-month moving average of volumes set at 3,030,158, a situation that encourages medium-term operations due to the interest shown by investors.