40 billion pounds of tax increases assumed, for investments in public services running out of steam such as “schools, hospitals and roads”… Keir Starmer’s Labor government presented on Wednesday October 30, after a record 117 days in the making, his first budget since coming to power in the United Kingdom in July. And the latter is already roundly criticized by the conservatives.

The most criticized measure: the bulk of the tax increase will come from an increase in employer contributions, which should bring in 25 billion per year. A proposal which is the blessing of the opposition, which cries scandal by reminding Labor of its promise to spare “people who work”. Because because of this measure, “millions of workers will be faced with two years of wage stagnation” says the conservative daily The Daily Telegraphaccording to whom Labor’s budget “puts pressure on workers and businesses”. Even the left-wing daily The Guardian recognizes this: this increase in contributions is a “risky bet”, because “the Office for Budget Responsibility (OBR) estimates that companies will pass on the impact through a reduction in salaries”, recalls the media.

“Radical break”

During the budget presentation, Labor MPs focused on the chronic suffering of the NHS, the British health system, which is largely underfunded. It will therefore receive additional resources to the tune of 22.6 billion pounds by 2026, while education will benefit from 4 billion pounds of additional credits. But looking more closely at the budget, The Guardian highlights inconsistencies: “despite huge sums of money” being spent on public services “particularly the NHS, this year and next, investment subsequently declines”.

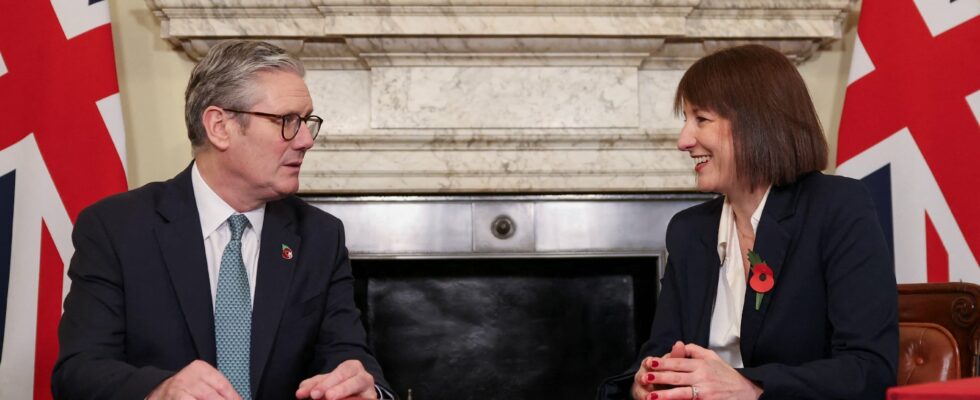

During her 80-minute address, Labor MP and Chancellor of the Exchequer Rachel Reeves “exceeded expectations by announcing record borrowing and spending outside of an economic emergency, but without the growth dividends in testify”, reports the Times. Which constitutes not only a “radical break in budgetary management in the United Kingdom”, judges the British daily, but also a decision “fraught with potential unforeseen consequences”. Because, analyzes the European site Politico“projected economic growth remains stubbornly slow according to official forecasts.” With growth already low and an increase in contributions that could be deferred to three-quarters of workers’ paychecks, this new budget “will reduce consumer spending and limit the economy to modest growth levels of 1.5 to 1.6 percent by the end of the decade,” predicts the Times.