Keep a close eye on your bank account statements at the moment: many people have noted withdrawals made without their consent by an infamous company.

It’s a sadly banal mishap that we could do without. By consulting your bank account, you notice that unknown withdrawals have been made and the transaction descriptions tell you absolutely nothing. Very often, it is a subscription to some service to which you subscribed a long time ago and whose existence you have forgotten, which you simply have to cancel if you no longer need it. But sometimes things are more complex, or more vicious. And you may find yourself unduly charged for a contract… that you terminated several years ago!

This is the bitter experience that many former customers of the Société Française d’Assurance Multimédia (SFAM), a company specializing in the sale of insurance and warranty extensions for mobile and multimedia devices, including smartphones. SFAM is a subsidiary of Indexia, a group made up of six companies, five of which are currently under legal action for anti-termination practices. Very unfavorably known to the trade regulatory and anti-fraud authorities, the group has also been banned from marketing new insurance contracts since April 2023. A great CV.

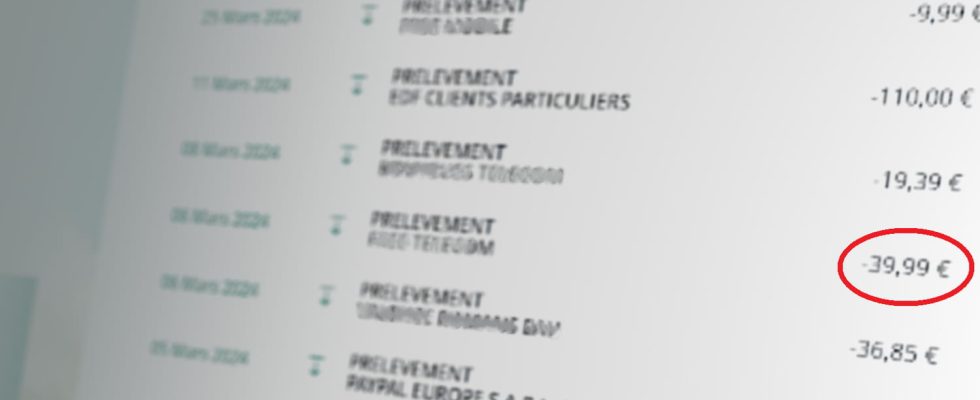

But this does not seem to prevent SFAM from making abusive deductions, for substantial amounts, from the accounts of former clients. As reported by 60 Millions de consommateurs in an article dated March 26, 2024, several ex-customers of the company were recently charged €29.99 and €69.99 in quick succession, for insurance that they had nevertheless canceled several years ago and despite the cancellation of the corresponding SEPA direct debit mandate. Similar cases had already been reported at the beginning of January by UFC Que Choisir, for equivalent amounts and using the same dubious methods.

Even if you currently have no current contract with SFAM, you could be a victim of this mishap if you purchased a phone or computer between 2017 and 2022 from one of the insurer’s many partners, such as Fnac-Darty or CDiscount, and that you took out insurance or an extended warranty sold with the device at the time, even if you have since canceled it. So monitor your bank accounts carefully in the coming weeks, and if you detect such a direct debit, immediately object to your bank, revoke the associated SEPA direct debit mandate and report the company on the SignalConso online service!