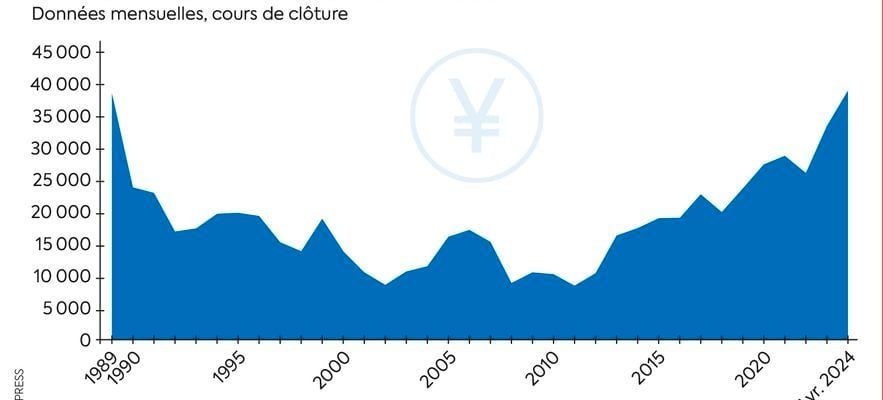

After many sluggish years, against a backdrop of an aging and deflationary economy, the Japanese stock market is once again attracting investors. As a result, the Nikkei 225, the main local index, reached a symbolic milestone in February, surpassing its high point, which dates back to the end of 1989, during the Japanese economic bubble. It even rose above 40,000 points at the beginning of March before giving up some ground. No matter: the index was still showing, at the beginning of April, almost 20% increase since the start of 2024 after an already very favorable year 2023. Another notable factor is that the Japanese central bank has turned the page on negative rates. “This March, the Bank of Japan (BoJ) closed a chapter in monetary history, becoming the last central bank to raise its key rate above zero,” emphasize Bill Papadakis and Homin Lee, macro strategists senior at Lombard Odier. An auspicious sign, revealing a normalization of inflation in the country.

This environment attracts investors, especially since many of them have reduced their position in another Asian market, China. “Japanese stocks display valuations that seem favorable to us,” assures Jean-François Chambon, Japan equity manager at Ofi Invest AM. For this expert, investor interest should in particular be supported “by the profitable growth of Japanese companies, which should persist, in our opinion, driven by rising prices.”

© / The Express

Stock market reactions sometimes excessive

However, caution remains in order after the gains already recorded. “Certain stock market reactions, based on long-term promises rather than actual achievements, have been excessive,” believes Hubert Goyé, the founder of Graphène Investments, judging that the current market is driven more by flows than economic fundamentals. “Unlike small Japanese companies, large ones at least benefit from very solid balance sheets, which it is still possible to take advantage of under attractive conditions, as long as the Bank of Japan remains very accommodating,” he advises.

It is essential to use funds: you will find good quality ones at Fidelity, M & G Investments, JP Morgan AM… Some may even be eligible for the stock savings plan, such as the CM-AM Japan Index 225 (Credit Mutuel AM) and Fédéral Indiciel Japon (Fédéral Finance Gestion). Be careful of currency variations, it is better to favor shares hedged against exchange risk.

.