“Is it a good time to invest in the stock market?” ; “What if it’s already too late?” ; “I might be better off keeping this money available just in case”… There is a simple remedy to combat financial procrastination: set up automatic payments into an investment and forget about it. “This allows us to free ourselves from psychological biases: the investment is made mechanically,” summarizes Matthias Baccino, director of distribution in Europe for Trade Republic, an online broker which offers scheduled investment plans.

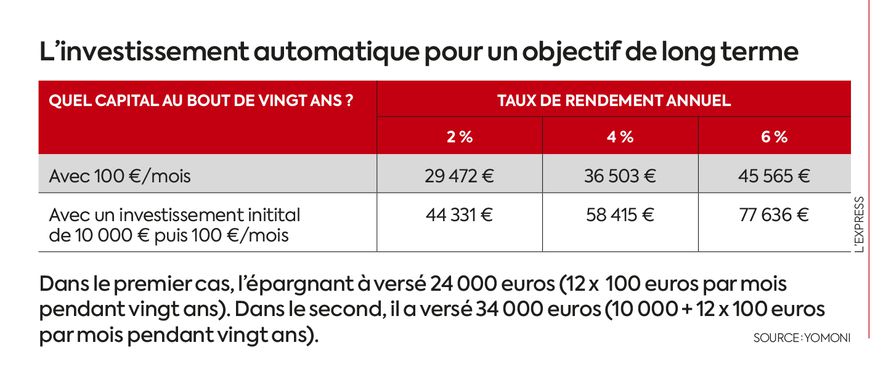

Automatic investment for a long-term objective.

© / The Express

The principle has existed for years in banking networks, often on a Livret A, a housing savings plan (PEL) or a life insurance contract, but also in the context of employee savings or a plan retirement savings. However, scheduled payments take on their full meaning on risky vehicles such as shares because they make it possible to smooth the entry point into the market. Let’s imagine a saver placing 100 euros per month in a European equity fund whose value is 10 euros the first month. He therefore buys 10 shares. The following month, the markets lost ground and the fund was worth only 9 euros. The saver this time subscribes to 11.1 shares, still with his 100 euros. Conversely, he will only buy 8.3 shares if the fund climbs to 12 euros. In other words, the investor acquires more shares when the market falls and less when it rises, which helps to optimize its cost price. “You must of course resist the urge to interrupt your scheduled payments if the markets fall for a few months. The point is precisely to no longer ask yourself any questions” recalls Nicolas Perot, financial markets expert with Yomoni.

If scheduled payments make sense at any age, the ideal is to start as early as possible, even if it means only spending a small amount. “You have to adopt good reflexes: when you benefit from a salary increase, it is smart to devote part of it to scheduled payments. This will be completely painless,” advises Franklin Morin, investment director of the online platform Nalo, of which 8 out of 10 customers have set up automatic payments on their life insurance.

100 euros saved each month, 40,000 euros twenty years later

Because it is over time that the savings effort bears fruit. Thus, 100 euros set aside each month on an investment yielding an average of 5% per year turns into 15,336 euros after ten years and into… 40,480 euros after twenty years. Surprising? No. By doubling the duration, we multiply the gain by 2.6 thanks to the “snowball” effect. Concretely, the capital gain realized on an investment is itself reinvested and in turn grows. Be careful, the management costs of the chosen investment reduce its performance: the higher they are, the less favorable the “snowball” effect. “Scheduled payments are therefore much more effective on funds with low management costs such as index products,” recalls Matthias Baccino.

Automatic investment programs respond well to a long-term objective such as preparing for retirement, since they allow you to build up capital over time, particularly if the money is invested in a life insurance contract. or a retirement savings plan in order to benefit from the favorable taxation of these two envelopes. But they can also satisfy a medium-term objective, such as making a contribution towards the purchase of your main residence. It is then necessary to calculate the monthly savings effort necessary to obtain the desired capital. Calculators available online (notably on the website Finance for All) give the answer: to reach 100,000 euros, you must invest 652 euros per month at 5% for ten years or 379 euros per month for fifteen years. Chi va piano va sano e va lontano…