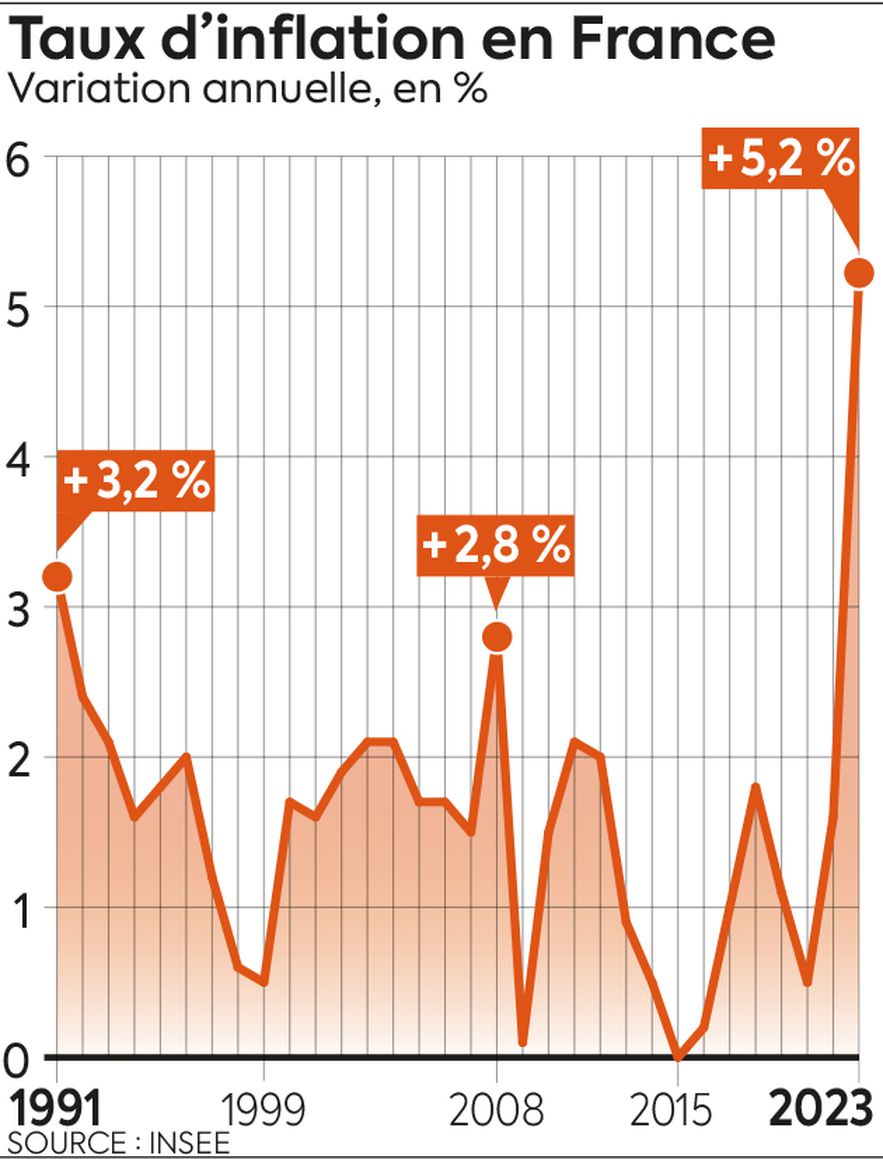

For more than thirty years, savers have been fed lower interest rates, with the appearance of an extraordinary phenomenon: negative rates. This period is closed. “What led to a paradigm shift was the acceleration of inflation and the reaction of central banks that followed,” says Guillaume Berthiaux, head of Sofidy private management.

Indeed, the economic boom that accompanied the end of the pandemic, as well as the dumpsters of liquidity brought in by monetary authorities and governments, have begun to sway labels. Confinements in China, the war in Ukraine and its consequences on energy prices have finished setting fire to the powder. Result: at the end of 2022, the annual inflation rate in the euro zone stood at 9.2%, with rates above 20% in countries such as Lithuania, Latvia and Hungary…

To calm this surge, the main central banks decided to tighten their policies by raising their key rates, which had repercussions on long-term interest rates. Thus, the French State, which borrowed on the markets for a horizon of ten years at 0% at the start of 2022, must now offer a remuneration of 2.85% on average since the beginning of the year.

Don’t stand still

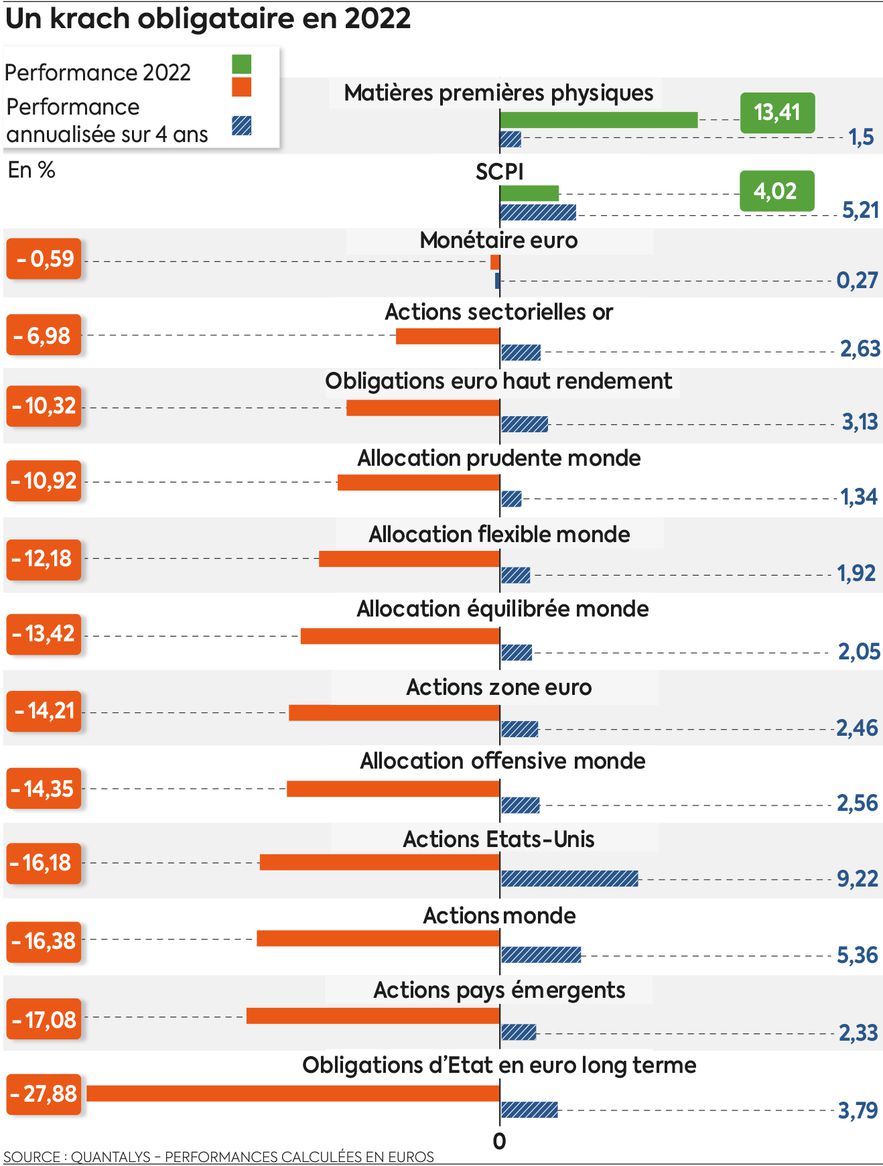

This reversal had a marked impact on major investment categories last year, knocking the stock and bond markets down. But it also led to a slowdown in growth and revealed weaknesses in the banking sector, whether in the United States, with Silicon Valley Bank, or in Europe with Credit Suisse.

In this context, the saver cannot stand still. “Inflation is here to stay, because it is a structural movement”, anticipates Alain-Pierre Belchior, director of the financial offer at UFF. He must also accept a minimum of risk. Indeed, in a context of high inflation, maintaining the purchasing power of savings represents a real challenge.

It is in the world of rates that the opportunities are the most numerous. Regulated savings accounts (Livret A and sustainable and solidarity development booklet) have seen their yield raised from 0.5% at the start of 2022 to 3% since February 1, 2023. Low-income households eligible for the popular savings account (LEP) can even claim a remuneration of 6.1%.

© / Art Press

The interest paid by funds in euros has also recovered, to 2% on average in 2022. Even monetary Sicavs, which have fallen into disuse, are regaining their luster. “These products, which replicate the monetary rate of the European Central Bank, i.e. nearly 3% gross of fees currently, represent a good alternative to funds in euros”, estimates Amaury Demarta, co-founder of the firm Millenium private management. A fortiori if key rates continue to rise.

Consider bond funds

However, bond funds offer the greatest potential. Certainly, last year, this market experienced a real crash: with the rise in interest rates, issuers had to offer higher remuneration for financing. As a result, the old titles, less well paid, were sold in favor of the new ones, causing their value to fall. But precisely: after this consolidation, it is possible to invest by taking advantage of attractive returns.

© / Art Press

On the equity side, there are many unknowns. Starting with the resilience of the economy in the face of interest rates and inflation. So far, corporate results have remained very strong, but rising costs and declining purchasing power should eventually weigh on their margins. In addition, the tense geopolitical environment is making the markets feverish. We must therefore advance on tiptoe by following two main principles: think very long term based on structural trends (energy transition, digitization of the economy, etc.) and watch for entry points. Equities have indeed rebounded strongly since the beginning of the year, and are becoming relatively expensive again. “Last year, certain sectors such as listed real estate or technology were sold off, points out Alain-Pierre Belchior. It may be interesting to invest in them in the coming months with a horizon of at least five years.” Finally, you have to keep a cool head, because violent movements can still occur. “In these periods of uncertainty, the nervousness is great”, underlines Guillaume Berthiaux.

© / Art Press

As for the real estate sector, it is also suffering. The scarcity of credit is deterring some buyers, with borrowing rates over twenty years now hovering around 3%. In addition, the High Council for Financial Stability (HCSF) has tightened borrowing conditions since January 1, 2022 by capping the level of debt at 35% of income and the repayment period at twenty-five years. Transactions are therefore rarer, and prices tend to contract. Protecting yourself from these declines means being very selective. “The rise in rates only reveals the difference between properties located in the best locations and those on the outskirts, which are less attractive”, underlines Alain-Pierre Belchior. Rental real estate also retains a major advantage, since rents are indexed to inflation. Some fund managers also see this situation as an opportunity to buy goods at a good price, and thus ensure a solid future return.

In this changing environment, regardless of the options chosen, one of the key rules in wealth management must be kept in mind: diversification. More than ever, you must avoid too much exposure to a single sector, a single asset class, a single player… And remain agile, in order to be able to adapt to the inevitable changes to come.