(Finance) – Definitely positive session for Interpump, which is up by 5.59%, continuing the positive trend drawn on Friday thanks to the quarterly accounts. “The results of the first quarter of 2022 confirm the extraordinary ability of the group to maintain a solid index of stability of income and growth performance – commented the president Fulvio Montipò -. Even in the face of an absolutely difficult situation – geopolitical situation, pandemic and inflation with prices of raw materials and energy out of control – we believe that the second quarter will also confirm excellent performance “.

In the light of the accounts, the analysts of the Equita research office have revised the recommendation on the share upwards, bringing it to “buy” ..

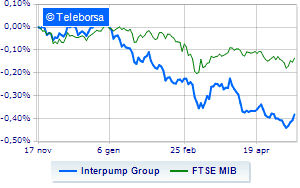

Comparing the performance of the stock with the FTSE MIBon a weekly basis, it is noted that the manufacturer of high pressure pumps maintains positive relative strength in comparison with the index, demonstrating greater appreciation by investors compared to the index itself (weekly performance + 13.9%, compared to + 2.37% of the main index of the Milan Stock Exchange).

The medium-term framework of Interpump reiterates the negative trend of the curve. In the short term, however, we see the possibility of a timid bullish impulse that meets the first resistance area at 41.43 Euro. First support identified at 39.97. The presence of any positive ideas tend towards an upward movement with a target of 42.89.