(Finance) – Strong rise for Intelwhich shows a burning rise of 9.22% on previous values.

The chip giant closed the third quarter with net profits slipping from 1 billion, equal to 25 cents per share, to 297 million (7 cents). On an adjusted basis, EPS stood at 41 cents, well above the consensus 22 cents.

THE revenues they fell from 15.3 to 14.2 billion dollars, but also in this case above the 13.6 billion estimated by analysts.

Guidance for the fourth quarter: Intel awaits revenues between 14.6 and 15.6 billion dollars (14.4 billion the FactSet consensus) and a EPS adjusted by 44 cents (analysts’ estimates of 33 cents).

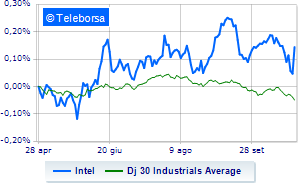

On a comparative level on a weekly basis, the trend of leading chip manufacturer highlights a more marked trend than the trendline of Dow Jones. This demonstrates the greater propensity of investors to buy towards Intel compared to the index.

The overall technical backdrop highlights strengthening bearish implications for the semiconductor giant, with negative stresses such as to force the levels towards the support area estimated at USD 34.51. Contrary to expectations, however, bullish pressures could push prices up to 36.62 where there is an important resistance level. The dominance of the bears fuels negative expectations for the next session with a potential target set at 33.5.