(Finance) – It’s going back a lot intelwhich exhibits a negative percentage change of 7.83%.

The warning and the under-expected quarterly results announced by the chip giant contributed to sinking the stock. Even the guidance was not the best: the group expects a net loss of 15 cents and a turnover of 10.5-11.5 billion, against a profit of 24 cents and a turnover of 14 billion expected by analysts.

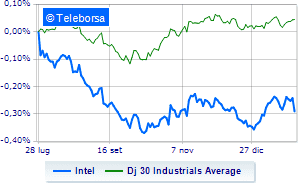

The one-week trend of major chip maker is more sluggish than the trend of Dow Jones. Such decline could trigger opportunities for the market to sell the stock.

The short-term technical status of intel highlights a broadening of the positive performance of the curve with the first resistance area identified at USD 28.16. Risk of a possible correction up to the target of 27.04. The expectations are for an increase in the uptrendline towards the resistance area 29.28.