Married, PACS, or cohabiting, you are looking for solutions to protect your other half but do not want to put the ring on your finger, to PACS, or to modify your matrimonial regime? Here’s how to rebalance the cards, without major upheaval.

- Invest in life insurance

In concubinage, life insurance is one of the rare magic wands – with death insurance – to transmit capital to one’s half without inheritance tax and escape 60% taxation (152,500 euros exempt per beneficiary for premiums paid before the age of 70). Married or PACS? Life insurance or not, your other half will have no right to settle. But as this envelope is “outside the estate” (the amounts are not taken into account), it allows you to grant the other a little more than his legal share of inheritance!

- Consider life insurance

This time, it is not an investment, but a pension tool to guarantee capital to the most fragile spouse. In the event of death after subscription, the latter receives a capital greater than the premiums paid. “But if the subscriber remains in good shape past 75 to 85 (the age limit varies according to the contracts), the contributions are lost”, warns Olivier Moustacakis, founder of Assurland (the “whole life contracts”, in much more expensive premiums, guarantee a capital regardless of the age of death). “Prefer a contract that does not require repeated health examinations, scrutinize the exclusions (sports, illnesses, etc.) and plan around 20 euros per month at age 40 to guarantee 100,000 euros, 35 euros at 50, 80 at 130 euros at 60 years old”, continues Olivier Moustacakis.

After the age of 65, the contributions reach 160 to 300 euros per month for 100,000 euros insured: the envelope then remains interesting only for cohabitants who wish to circumvent inheritance rights. The death benefit is only taxed at 20% after a deduction of 152,500 euros, knowing that only the contributions for the year of death are taken into account (the deduction is shared with life insurance ). Not understood ? Take Paul, who leaves his concubine Margot 140,000 euros in life insurance, plus a death benefit of 300,000 euros for which he contributed 4,000 euros last year. Margot receives 440,000 euros without tax: to assess whether the allowance of 152,500 euros is exceeded, only 144,000 euros (140,000 plus 4,000 euros) are taken into account.

- Make a simple donation

Married or PACS, and one of you would like to be better endowed in the event of death or separation? Give at least easy a simple donation, exempt from tax within the limit of 80,724 euros every fifteen years (cohabitants are taxed at 60% from the first euro). The help of a notary is not compulsory, and the manual gift must be declared via form n°2735 (available on impots.gouv.fr). “Such a donation inter vivos is irrevocable even if we divorce three months later”, warns Nicolas Jonquet, notary in Troyes (Monassier group). Logical, because the objective is also to protect oneself in the event of divorce, the amount of a possible compensatory allowance remaining uncertain. For Pacsés, the tax authorities however reserve the right to cancel the allowance of 80,724 euros if the Pacs is broken before the end of the following year.

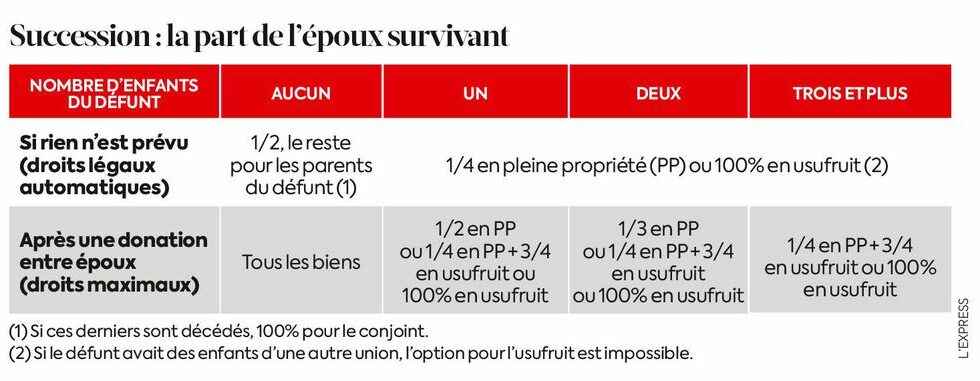

- Plan a donation between spouses

Spouses can also bequeath more than what the law provides by signing at the notary a “donation between spouses”, which takes effect on the first death (160 euros each). Most often, it leaves the surviving spouse the choice between the entire estate in usufruct (including with children from a first marriage), a quarter in full ownership plus three quarters in usufruct, or half, a third or one-quarter full ownership (See table). But it can also designate the spouse as universal legatee: he then receives the entire estate and any cherubim inherit nothing on the first death, unless they demand their hereditary reserve in court. Failing this, they only benefit once from the allowance of 100,000 euros (on the death of the second parent) and are therefore penalized, except if the inheritance is modest. “A gift between spouses remains more flexible than a will because it can provide for an option of “confinement” which leaves the survivor the possibility of modulating his rights for the benefit of his children, according to the state of his finances at the death of his half. “, specifies Me Jonquet. What if we change our minds? The gift between spouses is automatically canceled in the event of divorce, and otherwise can be revoked at any time, by notarial deed or will, without notifying the spouse.

The Express

“Pacsés, sign a will: your half will otherwise inherit nothing”, advises Me Jonquet. For the spouses, the will makes it possible to increase or specify the share of the spouse, just like a gift between spouses. The will can be signed at the notary (allow 75 to 150 euros) or written on plain paper, but never sign it together, under penalty of nullity.