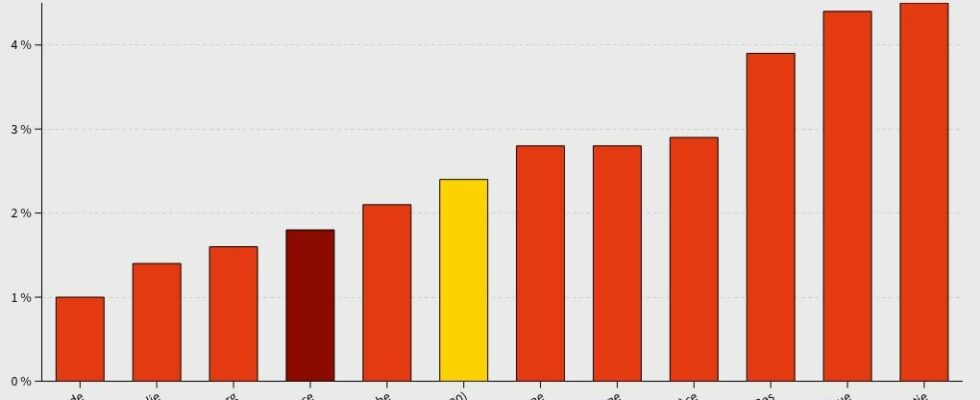

The sharp decline in French inflation in 2024, to 2% on an annual average according to INSEE statistics published on Wednesday January 15 (after a year of 2023 at 4.9%, and 2022 at 5.2%), places France in the position of a good student in the euro zone. According to the harmonized consumer price index (HICP), the comparison tool between EU countries, inflation in France rose to 1.8% last year, compared to 2 .4% in the euro zone. The range is from 1.0% for Ireland to 4.5% in Croatia. The leading economic power in the zone, Germany, recorded 2.8% inflation, just like Spain, and almost as much as Greece, at 2.9%. Several factors explain why France is doing rather well compared to its European neighbors.

A less competitive industry

If inflation is slowing in France, it is primarily due to a “less strong rise in wages than in the rest of the euro zone”, underlines Anthony Morlet-Lavidalie, economist for Rexecode. In comparison, wages in Germany “were very low over the last 10 or 15 years and are currently catching up”, which is causing a rise in the country’s inflation, he told AFP.

Furthermore, the consumer price index for manufactured products fell by 1.4% in December 2024 over one year, while it increased by 1.4% in December 2023, indicated INSEE. A decline which can be explained by several reasons. After two years at high levels, notably due to the outbreak of war in Ukraine, the prices of raw materials (energy, metals, etc.) calmed down in 2024. This reduced the production costs of manufactured goods, and therefore their prices. In a very competitive context, France, one of the most deindustrialized countries in Europe, is less armed than some of its neighbors.

“In a sector like automobiles for example, prices (of goods) have risen much more in Germany, because these are more high-end products,” explains the Rexecode economist. “France is specialized on some property; aeronautics, luxury, a little pharmacy, but for the rest, heavy chemicals or metallurgy for example, we have much less capacity to raise prices,” he adds.

The decline in inflation is also due to the lull in food prices in 2024. And in this sector, France has additional advantages. On the one hand, it “is an agricultural power”, which allows it to have less recourse to imports, and thus to avoid international pressure on prices. On the other hand, “French mass distribution is stronger than elsewhere, which makes it possible to negotiate lower prices for consumers,” notes Mr. Morlet-Lavidalie.

Tariff shield

France also “made much more use of price control tools, energy prices, and rents too, which were able to slow down the transmission of the inflation shock” when prices were at their highest, from 2022-2023, comments Fabien Bossy, chief economist France at Société Générale CIB. For example, the price shield on gas and electricity put in place at the end of 2021 and extended to 2024 helped to contain the rise in prices which more strongly affected neighbors.

“Far from being negligible”, the end of this tariff shield on electricity scheduled for February 1 – without a tax increase due to lack of budget – should produce a 14% reduction in the French bill, thanks to the decline in prices on the market, notes Mathieu Plane, economist at the French Observatory of Economic Conditions. A boon for households and the promise of “a few tenths of points of inflation less on the French side, which will certainly further accentuate the gap between France and its European partners”, he points out.