(Finance) – Forest Chemical Industries communicated thelaunch of the plan for the purchase and disposal of treasury shareswith effect from 24 February 2022pursuant to the authorization of the Shareholders’ Meeting of 18 February 2022.

The aims of the program are to allow the use of treasury shares in the context of operations related to the characteristic management or of projects consistent with the strategic lines that the Company intends to pursue, in relation to which the opportunity for share exchanges is realized, with the main objective therefore is to have a portfolio of treasury shares available in the context of extraordinary finance transactions and / or other uses deemed to be of financial-managerial and strategic interest for the Company with the aim of completing corporate integration with potential strategic partners, exchanges of shareholdings or commercial and / or professional agreements deemed strategic for the Company; and to intervene in compliance with the provisions in force, also through intermediaries, to contain anomalous movements in prices and to regularize the trend of trading and prices, in the face of momentary distortionary phenomena linked to an excess of volatility or insufficient liquidity trading or, more generally, to support the liquidity of the stock and the efficiency of the market.

The shares may be purchased in one or more solutions, up to maximum 1,000,000 shares (own), in compliance with the legal and regulatory provisions in force at the date of the transaction. It should be noted that the Company will not make use of derivative instruments. The purchases will be made within the limits of the distributable profits and the available reserves resulting from the last duly approved financial statements and within the limit of the maximum total outlay of 8,000,000.00 euros.

The deeds of disposal of treasury shares may take place at the price, or in any case according to criteria and conditions; the deeds of disposal and / or use of treasury shares may be carried out at the price or, in any case, according to criteria and conditions determined by the Board of Directors, having received with regard to the actual implementation methods used, the trend in share prices in the period prior to the transaction and the best interest of the Company.

The purchases may be made (also in revolving mode), in any case in compliance with the equal treatment of shareholders, by any of the following methods: (i) public purchase or exchange offer; (ii) purchases made on the Euronext Growth Milan market, according to market practices that do not allow the direct combination of purchase orders with certain sale offers, or (iii) with any other method provided for by the law and therefore through purchases in bulk or through auction procedures (including the so-called “Dutch” auction or “predetermined Buy-Backs”), as assessed from time to time in relation to the best implementation of the shareholders’ proxy.

The dispositions can be made, at any time, in whole or in part, in one or more times, even before having exhausted the purchases (and with the so-called revolving method), of the treasury shares purchased or in any case in the company’s portfolio, by means of alienation of the same on the market, in blocks or otherwise out of the market, accelerated bookbuilding, or the transfer of any real and / or personal rights relating to them (including, by way of example, securities lending).

In implementation of the resolution taken, the shopping of own shares may be carried out within 18 months from the date of the relative shareholders’ resolution. The disposal of treasury shares pursuant to the plan is not subject to time limits.

For the implementation, in compliance with the established parameters, of the aforementioned plan for the purchase and sale of treasury shares, the appointment of an appointed intermediary is envisaged.

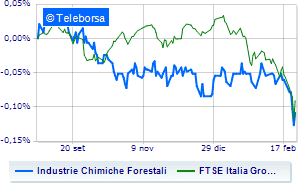

Today on the stock exchange, the protagonist Forest Chemical Industries among the titles of FTSE Italia Growthwhich closed the session with a rise of 2.07%.